Indonesian Rupiah Weakens Against US Dollar Amid Economic Shifts

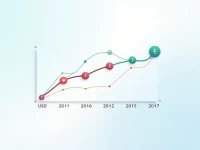

Currently, 1 Indonesian Rupiah (IDR) is equivalent to approximately 0.0000061 US Dollar (USD), while 1 USD can be exchanged for about 16,243.8 Indonesian Rupiah. Understanding this exchange rate is crucial for international trade and investment strategies.