Guide to Ocean Freight Export Key Trends and Practices

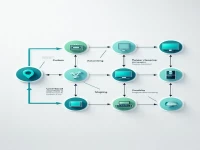

This article provides an in-depth analysis of the complete ocean freight export process, from trucking to customs clearance. It details the operational differences between Full Container Load (FCL) and Less than Container Load (LCL) shipments. Furthermore, it offers advice on key considerations and risk prevention strategies for critical stages. The aim is to help exporters mitigate risks, improve efficiency, and ensure the safe and smooth arrival of goods at their destination. This comprehensive guide is essential for navigating the complexities of ocean freight export.