State Bank of Pakistan Simplifies SWIFT Transfers for Global Payments

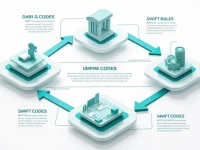

This article provides a detailed explanation of the SWIFT/BIC code SBPPPKKAXXX for the State Bank of Pakistan (SBP). It clarifies the definition and function of SWIFT codes, and when to use the head office code. The importance of branch codes is emphasized, and methods for finding specific branch codes are provided. Furthermore, the article outlines key considerations for using SWIFT codes for cross-border remittances, aiming to assist readers in conducting international transfers more accurately and efficiently. It serves as a practical guide for understanding and utilizing SWIFT codes in the context of Pakistani banking.