Guide to HS Codes for Product Classification and Tax Rebates

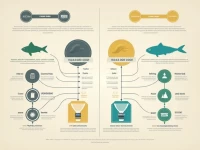

This article provides a detailed analysis of product classifications related to HS Code 150 and 15, including lard and fish oil. It discusses the tax refund policies and regulatory requirements for various products, aiming to support practices in international trade.