Master Importexport Commodity Classification for 20

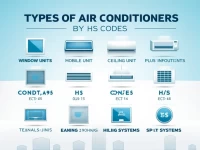

Struggling with complex commodity classification? For just 20 yuan, get professional classification services, quickly and accurately matching HS codes to avoid customs clearance risks and save time and effort. Whether you're an import/export company or a cross-border e-commerce seller, enjoy an efficient and convenient classification experience. We also offer value-added services such as AI tools, overseas warehousing, and website promotion, helping businesses easily expand into the global market.