Freight Industry Adopts 3D Market Strategy for Growth

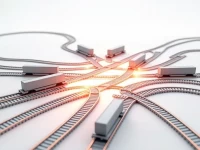

The freight industry is entering a three-dimensional market era, with spot, forward, and futures markets interconnected, increasing information transparency, and intensifying rate fluctuations. Companies need to understand market dynamics and utilize forward contracts and futures instruments to hedge risks, optimize price discovery, and develop three-dimensional execution strategies. This approach is crucial for gaining a competitive edge in the new market landscape. Effective risk management and strategic planning are essential for navigating the complexities and capitalizing on opportunities within this evolving environment.