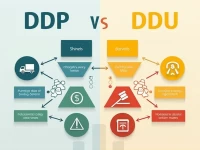

Ecommerce Guide Understanding DDP and DDU Incoterms

In cross-border e-commerce, the choice between DDP and DDU Incoterms is crucial. This article provides an in-depth analysis of their definitions, cost structures, risks, and applicable scenarios. It offers practical advice to help sellers optimize logistics solutions, reduce operating costs, enhance customer experience, mitigate potential risks, and achieve business growth. Understanding the nuances of DDP and DDU empowers sellers to make informed decisions regarding shipping responsibilities and cost allocation, ultimately leading to more efficient and profitable international transactions.