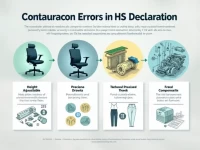

Common HS Declaration Errors and How to Avoid Them for Efficient Trade Compliance

This article analyzes five common errors in the HS declaration process, including incomplete declaration elements, ambiguous descriptions of function and use, and non-standard language. These errors can lead to rejection of declarations and may affect the entire customs clearance process. Through clear example analysis, this article aims to help practitioners improve the accuracy and professionalism of their declarations.