Guide to SWIFT Codes for Banco Central De Chile Transfers

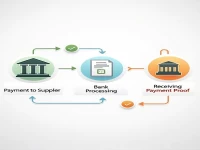

Understanding the SWIFT/BIC code of BANCO CENTRAL DE CHILE (BCECCLRM XXX) is crucial for ensuring successful international remittances. Correct usage of the SWIFT code helps avoid delays and errors in financial transactions, improving the efficiency of fund transfers. Familiarize yourself with the relevant information and adhere to transaction regulations to ensure the safety and smooth arrival of funds.