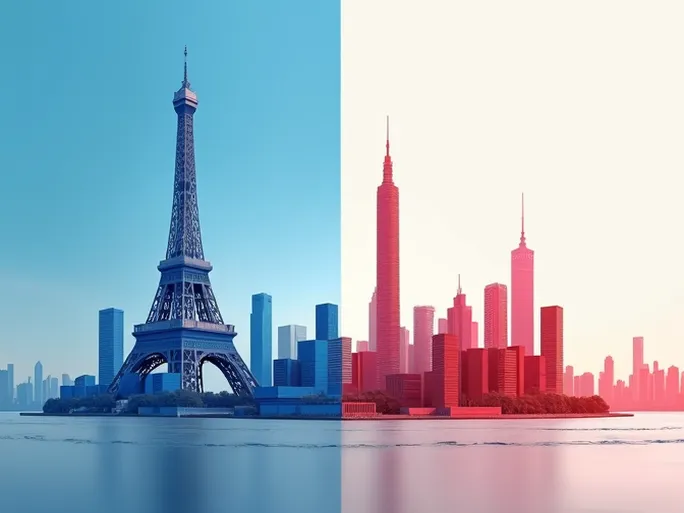

When the romance of the Eiffel Tower meets the brilliance of Shanghai's Oriental Pearl Tower in the tide of economic globalization, the ocean routes connecting China and France become vital arteries of trade, ceaselessly transporting goods and opportunities. Along these bustling maritime corridors, the Far East route and Southeast Asia route run parallel, jointly constructing the bridge of Sino-French commerce. Yet beneath this seemingly calm surface, undercurrents of cost, efficiency, and capacity quietly shape the course of these shipping lanes.

The Dual-Route Shipping Framework

Currently, China-France maritime transport primarily relies on two key routes. The traditional Far East-Europe route originates from major Chinese ports like Shanghai, Ningbo, and Qingdao, sails southward past the strategic hub of Singapore, traverses the Suez Canal, and finally arrives at French gateway ports including Marseille and Le Havre. The alternative is the emerging Southeast Asia-Europe route, departing from Vietnamese and Thai ports, crossing the Malacca Strait before heading toward France.

Route Advantages: Stability, Efficiency, and Diversity

The China-France shipping routes offer several distinct advantages. Route stability stands out as a key feature, with both corridors having matured through years of development, offering fixed schedules and reliable transit times. Abundant capacity represents another strength, as large cargo vessels frequently ply these routes with ample space to accommodate varying shipment volumes. The routes also demonstrate remarkable cargo versatility , efficiently handling containers, bulk goods, and liquid cargo alike. Advanced loading equipment at major ports in both nations further enhances operational efficiency.

The Cost Equation: Variables in Transit Economics

Shipping costs remain the paramount concern for all shippers. Multiple factors influence China-France maritime pricing: Cargo type plays a significant role, with container shipments generally commanding higher rates than bulk commodities. Distance differentials naturally make the Far East-Europe route more expensive than its Southeast Asia counterpart. Additionally, price volatility —driven by market demand, fuel price fluctuations, and other variables—requires constant monitoring.

Transit Times: Comparing the Routes

The Far East-Europe route typically requires 25-30 days transit, while the Southeast Asia-Europe alternative offers slightly faster delivery at 20-25 days—a difference attributable to the shorter sailing distance. Time-sensitive shipments may benefit from selecting the Southeast Asia pathway.

Freight Benchmarks: Navigating Price Ranges

Shipping rates between China and France remain dynamic, with standard container (TEU) prices generally fluctuating between $1,000-$2,000. These ranges continuously adjust based on market conditions, fuel costs, and other unpredictable factors, necessitating consultation with freight forwarders for real-time quotations.

As a critical component of bilateral trade, the stability and efficiency of China-France shipping routes directly impact both economies. With evolving global trade patterns, these maritime corridors will encounter new challenges and opportunities. Future development will hinge on optimizing route networks, reducing transportation costs, and enhancing service quality.