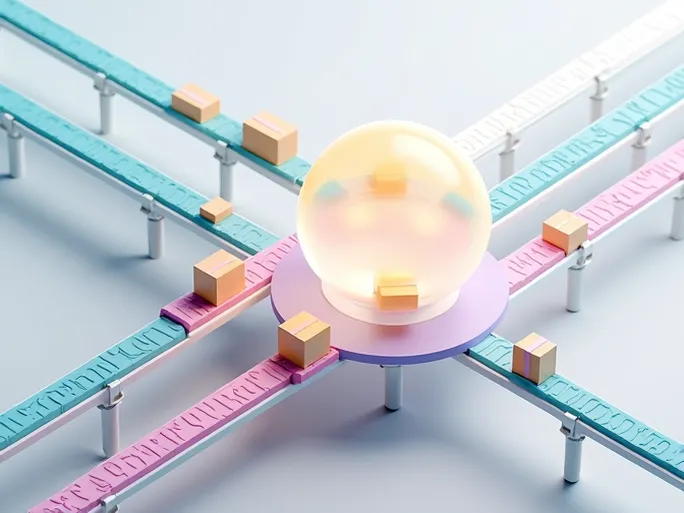

Imagine a flood of orders pouring into e-commerce platforms, with mountains of packages waiting to be delivered to households. Yet, even the slightest delay in logistics can lead to a sharp decline in user experience and directly impact a company’s profitability. The annual peak logistics season presents both opportunities and challenges. In an increasingly complex and volatile market, how can businesses strategize effectively to stay ahead?

In a recent episode of the Logistics Management Podcast, John Haber, President of the Parcel Division at Transportation Insight, shared his insights on key trends and critical issues in parcel, express, and last-mile logistics. The discussion covered peak season outlooks, rates and pricing, current service levels, and the growth of Amazon’s logistics network, offering valuable guidance for businesses navigating fierce competition.

Industry Veteran John Haber’s Expertise

With over 25 years of supply chain management experience, John Haber has helped global brands enhance supply chain efficiency while reducing transportation, distribution, and fulfillment costs. Before joining Transportation Insight, he served as CEO and founder of Spend Management Experts, which was acquired by Transportation Insight in January. Earlier in his career, Haber held multiple executive roles at UPS, focusing on corporate finance and strategy, and contributed to the development of profitability and cost models. He also managed UPS’s National Customer Profitability Department, auditing pricing and profitability for the company’s top clients. His deep financial expertise and extensive collaboration with shippers enable him to provide unique perspectives on strategic supply chain planning, including distribution optimization, transportation cost analysis, and carrier contract compliance.

Peak Season Outlook: Balancing Opportunities and Challenges

The peak season is a critical test for the logistics industry. While surging e-commerce orders present significant growth opportunities, the increased volume also demands higher performance from logistics infrastructure, operational capacity, and service levels. Haber emphasizes the need for thorough preparation, including inventory optimization, transportation capacity planning, warehouse efficiency improvements, and last-mile delivery enhancements.

Key Strategies for Peak Season Success

- Accurate Demand Forecasting: Haber highlights that precise demand forecasting is essential for managing peak season challenges. Businesses must leverage historical data, market trends, and promotional insights to predict order volumes and allocate resources accordingly. Underestimating demand can lead to stockouts, while overestimating may result in wasted resources.

- Flexible Transportation Capacity: During peak periods, transportation resources are often strained. Companies should establish partnerships with multiple carriers to secure sufficient capacity and explore multimodal solutions to reduce costs and improve efficiency.

- Warehouse Efficiency as a Competitive Edge: Warehouses serve as the backbone of logistics operations. To handle increased inbound, picking, packing, and outbound tasks, businesses must optimize layouts, adopt automation, and enhance workforce training. Safety protocols are equally critical to protect both goods and personnel.

- Enhancing Last-Mile Delivery Experience: The final leg of delivery is where customer satisfaction is determined. Challenges such as traffic congestion, delayed deliveries, and increased complaints require optimized routing, smart delivery systems, and proactive customer communication.

Rates and Pricing: Staying Competitive

In a crowded logistics market, pricing strategies play a decisive role in attracting and retaining customers. Haber advises businesses to balance profitability with competitiveness by:

- Monitoring Market Trends: Keeping abreast of competitor pricing through market research and industry reports helps businesses adjust their strategies effectively.

- Optimizing Cost Structures: Reducing transportation, warehousing, and labor costs through process improvements and technological innovation allows for more competitive pricing.

- Offering Differentiated Services: Value-added services such as customized delivery options, rapid response times, and dedicated support can justify premium pricing.

- Adopting Dynamic Pricing: Adjusting prices based on seasonal demand—raising them during peak periods and lowering them in slower seasons—can help attract and retain customers.

Service Levels: Elevating Customer Satisfaction

Service quality remains a key differentiator in logistics. Haber recommends focusing on:

- Faster Transit Times: Optimizing routes, leveraging expedited shipping, and strengthening carrier partnerships can improve delivery speed.

- Higher On-Time Performance: Real-time shipment tracking and proactive issue resolution ensure timely deliveries.

- Transparency in Tracking: Providing customers with live updates on shipment status enhances trust and satisfaction.

- Superior Customer Service: A responsive and knowledgeable support team is crucial for addressing inquiries and resolving complaints efficiently.

The Rise of Amazon Logistics: Implications for the Industry

Amazon’s rapid expansion in logistics has reshaped the competitive landscape. While its innovations in automation, drone delivery, and smart logistics set industry benchmarks, traditional logistics providers face mounting pressure to adapt.

Strategies to Compete with Amazon

- Differentiation: Specializing in niche markets or tailored logistics solutions can help businesses stand out.

- Technology Adoption: Investing in IoT, AI, and blockchain-driven logistics systems can boost efficiency and service quality.

- Collaboration: Partnering with e-commerce platforms or other logistics firms can expand market reach and mitigate competitive threats.

Conclusion: Adapting to Secure the Future

In a rapidly evolving logistics sector, businesses must remain agile, leveraging data-driven insights and innovative strategies to thrive. Haber’s analysis provides a roadmap for navigating peak season complexities and sustaining long-term competitiveness.