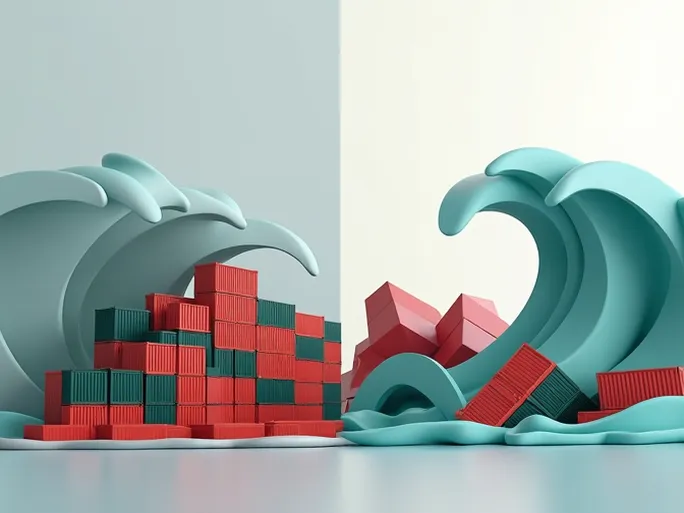

MIAMI, FL – Descartes Systems Group (NASDAQ: DSGX, TSX: DSG), a leading provider of logistics cloud-based solutions, has released its latest Global Shipping Report , revealing a significant decline in U.S. port container volumes in May after months of growth. The findings suggest emerging impacts of international trade fluctuations, presenting businesses with dual challenges of supply chain disruptions and rising costs.

Key Findings: U.S. Import Data Shows Sudden Reversal

The report highlights that U.S. ports handled 2,177,453 twenty-foot equivalent units (TEUs) in May, marking a 9.7% decrease from April and a 7.2% year-over-year decline. This abrupt reversal breaks the previous months' import growth trend, clearly indicating intensifying trade volatility and potential economic headwinds.

"After several months of import growth and April's front-loading surge, the effects of new tariffs became evident in May," noted Descartes analyst Jackson Wood. "The impact of shifting U.S. policies toward China is clearly reflected in monthly trade flows." Wood emphasized that businesses must closely monitor policy changes and rapidly adjust procurement strategies to mitigate potential negative effects.

Tariff Fluctuations and Strategic Responses

While the 90-day tariff agreement between the U.S. and China may provide temporary relief for American importers, long-term projections suggest continued declines in Chinese goods imports. Companies are actively reassessing procurement strategies to address rising landed costs and diversifying supplier bases to reduce single-market dependence.

Adjustments to the "de minimis rule" for low-value Chinese goods have further compounded trade cost pressures, forcing businesses to reconsider supply chain structures and explore production relocation to alternative countries.

Historical Context: Resilient Demand Amid Growing Risks

Despite May's sequential decline—breaking a seven-year growth pattern (excluding 2020)—import volumes remain 4.3% above pre-pandemic May 2019 levels, indicating underlying economic resilience. However, Descartes warns: "While the year began strongly, May's contraction marks the first significant pullback, reflecting tariff volatility and mounting trade pressures."

China's Dramatic Export Decline

The report reveals a 20.8% month-over-month drop (804,122 TEUs) in U.S. imports from China—the steepest monthly decline since March 2020—with a 28.5% year-over-year decrease. China's share of total U.S. container imports fell to 29.3%, the lowest in over two years.

Los Angeles and Long Beach ports bore the brunt, experiencing 31.6% and 29.9% declines respectively. As America's largest container ports, these decreases underscore how U.S.-China trade tensions disproportionately affect West Coast economies.

Port Performance and Regional Shifts

Key additional findings include:

- Top 10 Port Decline: Combined volumes at major U.S. ports fell 10.7% year-over-year (217,112 TEUs), with Los Angeles (-18.4%) and Long Beach (-22.4%) suffering most. Charleston (+6.0%) and Baltimore (+2.6%) gains suggest resilient regional demand and/or rerouted cargo.

- Export Nation Trends: Imports from top 10 source countries dropped 11.4% sequentially (192,313 TEUs). While China led declines (-20.8%), India (+5.7%), South Korea (+4.9%), and Vietnam (+2.3%) saw growth, potentially signaling trade diversion.

- Coastal Share Rebalancing: East/Gulf Coast ports captured 44.5% of U.S. imports (+3.1% sequentially), while West Coast share fell to 38.1% (-4.4%), reflecting geographic impacts of China's export slowdown.

Strategic Recommendations for Businesses

To navigate increasing trade complexity, companies should consider:

- Supplier Diversification: Reduce reliance on single-source markets to mitigate geopolitical risks

- Supply Chain Optimization: Enhance visibility and flexibility through advanced management technologies

- Risk Management Frameworks: Develop contingency plans for trade disruptions

- Technology Adoption: Leverage IoT, AI and blockchain for operational efficiency

- Policy Monitoring: Track regulatory changes for timely strategic adjustments

About Descartes Systems Group

Descartes (NASDAQ: DSGX, TSX: DSG) is a global leader in logistics cloud platforms, serving over 65,000 customers across 160+ countries. Its solutions span transportation management, warehouse operations, customs compliance, and global trade intelligence, helping organizations achieve logistics excellence through productivity, safety, and sustainability enhancements.