The global logistics industry faces unprecedented challenges amid economic uncertainty and geopolitical tensions. The latest TD Cowen-AFS Freight Index Q1 report provides critical insights into truckload (TL), less-than-truckload (LTL), and parcel shipping sectors, offering market participants valuable decision-making tools.

1. The TD Cowen-AFS Freight Index: A Market Barometer

1.1 Methodology and Data Sources

This quarterly index combines AFS Logistics' extensive freight transaction data with TD Cowen's analytical expertise. The model incorporates macroeconomic indicators (GDP growth, inflation rates, PMI) and microeconomic factors (carrier rate increases, fuel prices, capacity levels) to forecast pricing trends across transportation modes.

1.2 Key Value Propositions

- Predictive analytics for TL, LTL, and parcel segments

- Historical benchmarking against 2018 baseline data

- Integrated assessment of supply-demand dynamics

2. Macroeconomic Context

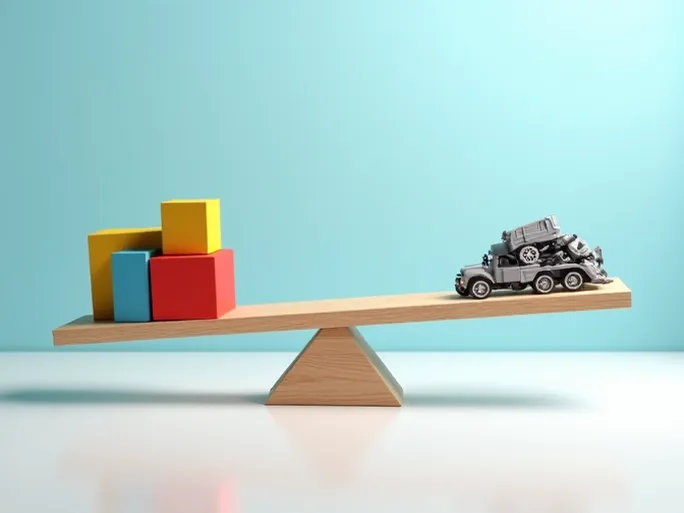

Persistent inflation, slowing global trade growth, and ongoing supply chain realignments continue shaping freight markets. These factors create divergent pressures across transportation sectors:

3. Truckload Market: Tentative Recovery Signs

3.1 Current Conditions

Spot rates show modest improvement with rejection rates climbing to 3.7% in Q1, though contract rates remain depressed. Linehaul costs reached an eight-quarter low, still 11.6% above pre-pandemic levels.

3.2 Outlook

The index forecasts flat per-mile rates for Q1 2025 at 5.1% above baseline, reflecting persistent overcapacity. Digital transformation and route optimization emerge as key strategies for carriers.

4. Parcel Sector: Pricing Discipline Amid Soft Demand

4.1 Market Dynamics

Carriers successfully implemented peak season surcharges, with ground parcel accessorial fees jumping 16.4% QoQ. However, aggressive discounting drove express parcel rates down to just 0.5% above baseline.

4.2 Competitive Landscape

Ground parcel outperformed express, with rates reaching 24.4% above baseline in Q4 2024. Projected 2025 GRI increases may push this to 28.2%, though still below 2023 peaks.

5. LTL Market: Pricing Power Eroding

5.1 Yellow Freight Aftermath

The carrier bankruptcy created temporary capacity tightness, sustaining elevated rates since Q3 2023. Recent data shows weakening discipline, with fuel surcharges declining 5.5% QoQ.

5.2 Forecast

The per-pound rate index is projected at 62.4% for Q1 2025 - just 0.4% above 2024 levels, signaling slowing growth momentum.

6. Strategic Recommendations

- Enhance data-driven decision making

- Optimize network design and modal mix

- Implement dynamic pricing strategies

- Accelerate digital transformation initiatives

- Develop sustainability programs

7. Conclusion

The report highlights continued market divergence across freight segments. While some sectors show stabilization, underlying demand weakness and competitive pressures persist. Market participants must balance short-term tactical adjustments with longer-term strategic investments in technology and operational efficiency.