As Temu's rapid expansion in the U.S. market comes to an abrupt halt, industry observers are questioning whether its aggressive discount strategy can maintain momentum. Recent market data reveals a sharp decline in Temu's American sales, while rival Shein demonstrates markedly different performance—highlighting evolving market dynamics.

Steep Decline in Market Performance

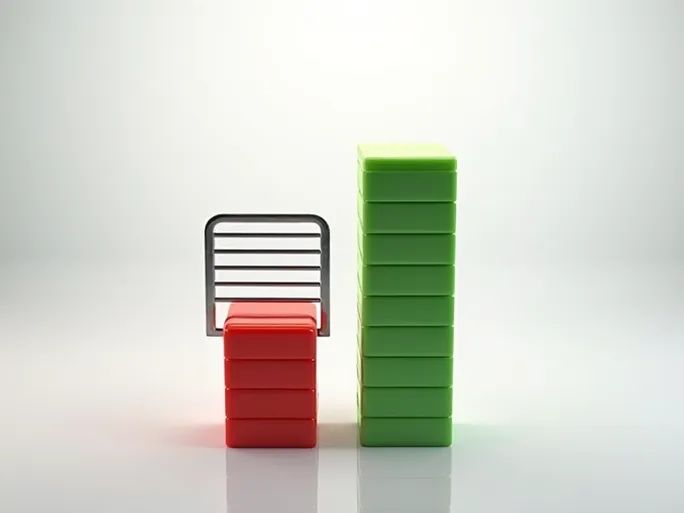

Between May 11 and June 8, 2025, Temu's weekly U.S. sales dropped by over 25% year-over-year—a significantly steeper decline than competitors Shein, Walmart, and Amazon. This dramatic downturn has raised concerns about Temu's long-term viability in the critical North American market.

Advertising Pullback and Strategic Shifts

Analysts attribute Temu's sales collapse primarily to radical changes in advertising strategy. During 2024, the platform invested heavily in marketing campaigns, sometimes launching 10,000+ new ads daily to build brand recognition. However, by June 2025, daily ad volume collapsed to single digits—with some days showing zero new campaigns.

This advertising retreat suggests Temu may be reallocating resources to European markets, where regulatory conditions remain more favorable for its business model.

Tariff Policy Headwinds

Previously, Temu and Shein leveraged de minimis tariff exemptions to ship low-cost apparel and household goods directly to U.S. consumers. However, 2025's stricter U.S. customs enforcement eroded this pricing advantage—particularly damaging Temu's value proposition.

Shein's Contrasting Stability

While Temu struggles, Shein has maintained steadier performance—achieving single-digit sales growth since June 1. The rival platform sustains consistent daily ad volumes (typically dozens to hundreds of new campaigns), suggesting more sustainable marketing practices.

Strategic Adjustments Underway

Temu's spokesperson confirmed collaboration with merchants to stabilize pricing—an acknowledgment that pure discounting may no longer suffice. Whether these measures can restore competitiveness remains uncertain, with the platform's global expansion strategy now facing its most serious test.