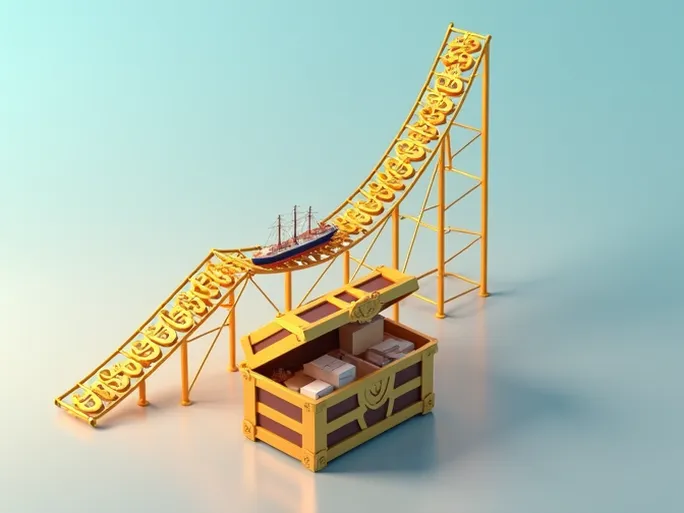

Cross-border e-commerce exports to the U.S. market are experiencing significant turbulence due to recent changes in tariff policies for low-value goods (under $800). The repeated adjustments to the de minimis tariff exemption policy have created both challenges and opportunities for online sellers.

Policy Background: A Series of Reversals

The U.S. administration initially signed an executive order to eliminate the tariff exemption for low-value goods, scheduled to take effect on February 4. This move aimed to increase customs revenue and potentially support domestic e-commerce businesses. However, implementation encountered unexpected developments.

The U.S. Postal Service temporarily suspended acceptance of packages from mainland China and Hong Kong, only to resume service shortly afterward. Subsequently, a new executive order postponed the elimination of the de minimis exemption. This means Chinese shipments will continue to enjoy tariff-free entry for now, though the duration depends on when the Commerce Secretary confirms the establishment of a proper customs revenue processing system.

Impact Analysis: Short-Term Disruption and Long-Term Adaptation

Legal experts note that eliminating the de minimis exemption would likely affect U.S. consumers' purchases of low-cost goods in the short term, while creating opportunities for domestic and other international e-commerce players to fill the gap. This highlights the competitive dynamics behind the policy changes that cross-border sellers must navigate.

Strategic Responses for E-Commerce Sellers

Facing policy uncertainty, cross-border sellers should adopt proactive measures:

- Leverage the current window: Optimize product offerings and clear inventory while the tariff exemption remains in effect.

- Diversify markets: Reduce reliance on any single market by expanding to other international destinations.

- Improve logistics: Explore more efficient shipping solutions, including overseas warehouses to enhance delivery speed.

- Ensure compliance: Strictly adhere to U.S. customs regulations and import requirements.

- Monitor policy changes: Stay informed about tariff policy developments to adjust strategies promptly.

- Enhance product value: Improve quality, design, and branding to increase competitiveness.

Future Outlook: Balancing Risks and Rewards

While the evolving U.S. tariff policy presents challenges for cross-border e-commerce, it also creates opportunities. Through strategic adaptation and continuous competitiveness improvement, sellers can identify new growth potential in the U.S. market. Success will depend on maintaining market awareness, operational flexibility, and product excellence.