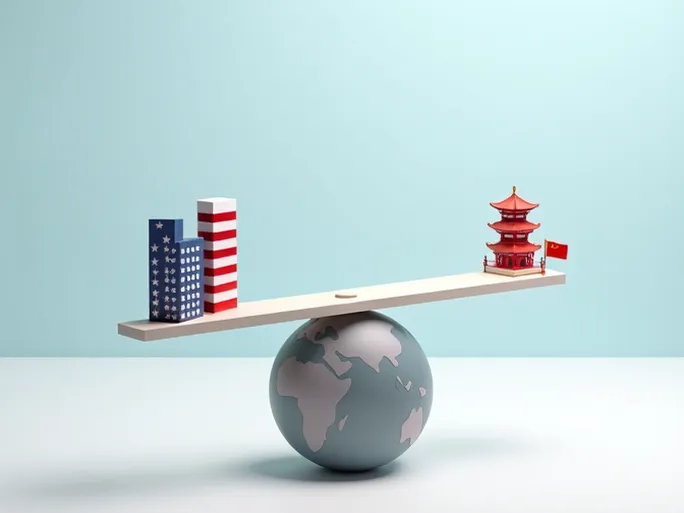

In a significant development for global trade, the United States and China have reached a temporary agreement to suspend certain tariff measures, marking a potential turning point in their strained economic relationship. The breakthrough came after high-level trade talks in Geneva on May 12, where both sides issued a joint statement announcing the partial tariff suspension.

The agreement, which took effect by May 14, includes the U.S. pausing planned 24% tariffs on Chinese goods (including those from Hong Kong and Macau) that were set to take effect in April. In reciprocal action, China suspended its corresponding 24% tariffs and removed two previously implemented countermeasures.

Market Reacts to Potential Trade Thaw

The announcement has sent ripples through global markets, with analysts predicting a possible surge in trade activity between the world's two largest economies. The temporary truce comes after months of escalating tensions that saw U.S. tariffs on some Chinese goods reach as high as 145%, leading to a dramatic 30-40% drop in April shipments from China to the U.S., according to Maersk, the world's largest shipping company.

With the tariff risk temporarily eased, market observers anticipate a rapid reversal in trade patterns. U.S. importers who had adopted a "wait-and-see" approach may now rush to fulfill previously suspended orders, while Chinese exporters are expected to accelerate shipments during the 90-day window.

Shipping Industry Braces for Challenges

The sudden policy shift could create significant challenges for global supply chains. Shipping industry experts warn of potential "container rush" scenarios as exporters compete for limited vessel space. The combination of pent-up demand and the traditional North American summer restocking season may lead to:

- Sharp increases in freight rates across Pacific routes

- Intensified competition for shipping capacity

- Potential port congestion as volumes rebound

Lars Jensen, a veteran shipping market analyst, notes that the 90-day policy window coincides with the traditional peak shipping season for U.S. holiday goods. "We should expect U.S. ports to transition from current low-volume conditions to handling sudden influxes within 3-6 weeks," Jensen cautioned, highlighting potential bottlenecks in port operations, warehousing, and inland transportation networks.

Strategic Considerations for Exporters

Chinese exporters face both opportunities and challenges in navigating the evolving trade landscape. Key recommendations include:

- Prioritize shipments: Maximize exports during the 90-day tariff pause window

- Diversify logistics plans: Develop alternative shipping routes and methods

- Enhance supply chain flexibility: Adapt quickly to changing market conditions

- Maintain client communication: Keep buyers informed about market developments

Long-Term Outlook Remains Uncertain

While the temporary tariff suspension represents progress, fundamental issues in U.S.-China trade relations remain unresolved. The agreement's 90-day timeframe creates uncertainty about what will follow this interim period. Market participants are advised to monitor developments closely while preparing for various potential scenarios.

The shipping industry's ability to respond to sudden demand fluctuations will be tested, particularly given previous capacity reductions implemented during the trade downturn. Analysts suggest that the speed at which carriers can reactivate idled vessels and routes will significantly impact market dynamics in coming weeks.

As global trade enters this transitional phase, businesses that demonstrate adaptability and strategic foresight may be best positioned to capitalize on emerging opportunities while mitigating risks in this evolving economic landscape.