Imagine walking into a store filled with products but without any customer reviews to guide your choices. This may soon become a reality on Amazon, as the e-commerce giant experiments with removing product ratings from search results.

Prime Day Preparations and New Fee Structure

As sellers recover from the traditional post-sales slump following major shopping events, Amazon has announced its Fall Prime Day will take place in October. However, a significant change awaits merchants: Prime Exclusive Discounts will now come with a fee.

Starting August 14, 2024, U.S. sellers will need to pay $50 per promotional activity during Prime Day events. The fee applies only if at least one item sells during the promotion, and multiple products can be grouped under a single fee. Non-event promotions remain free.

Merchants are adapting with two key strategies:

- Consolidated submissions: Grouping all Prime Day ASINs into single promotions to minimize fees

- Strategic timing: Postponing promotions for non-core products until after Prime Day to leverage residual traffic without incurring fees

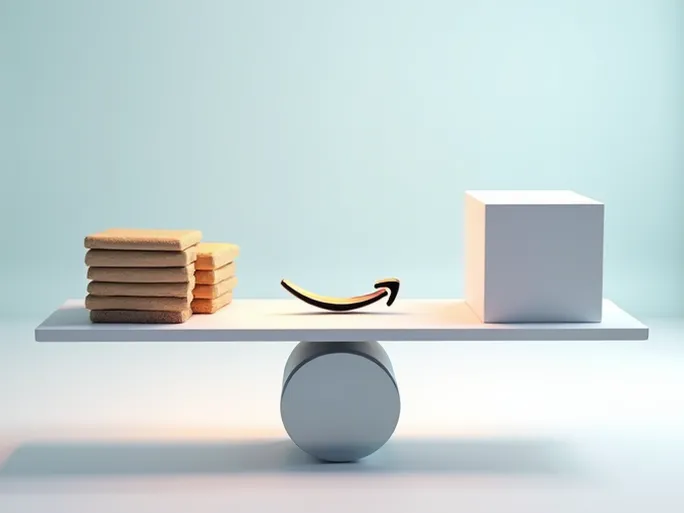

The Disappearing Ratings Experiment

Amazon is currently testing a radical change to its interface: removing star ratings and review counts from search results. In affected categories like water flossers, shoppers now see only product images, titles, monthly sales figures, and prices—with ratings visible only on individual product pages.

Amazon confirmed this as an ongoing test but declined to specify its duration or potential permanent implementation.

Divergent Views Among Sellers

The marketplace community remains divided about the potential impact:

Critics argue that removing visible ratings makes initial product assessment difficult for consumers, potentially hurting conversion rates. Proponents suggest this levels the playing field by reducing the advantage of established products with numerous reviews, giving new listings better visibility opportunities.

Amazon's Potential Motivations

This change appears aligned with Amazon's broader efforts to:

- Refocus merchants on product quality rather than review manipulation

- Reduce the impact of fraudulent reviews despite strict enforcement

- Improve overall platform product standards

Adaptation Strategies for Sellers

Merchants who prioritize product quality may benefit most from these changes. Key adaptation strategies include:

- Doubling down on product development and quality control

- Enhancing product detail pages with rich media and comprehensive descriptions

- Encouraging authentic customer reviews through legitimate channels

- Monitoring market trends and consumer preferences

- Maintaining strict compliance with platform policies

As Amazon continues evolving its marketplace dynamics, sellers who quickly adapt to these changes while maintaining product excellence will be best positioned for long-term success.