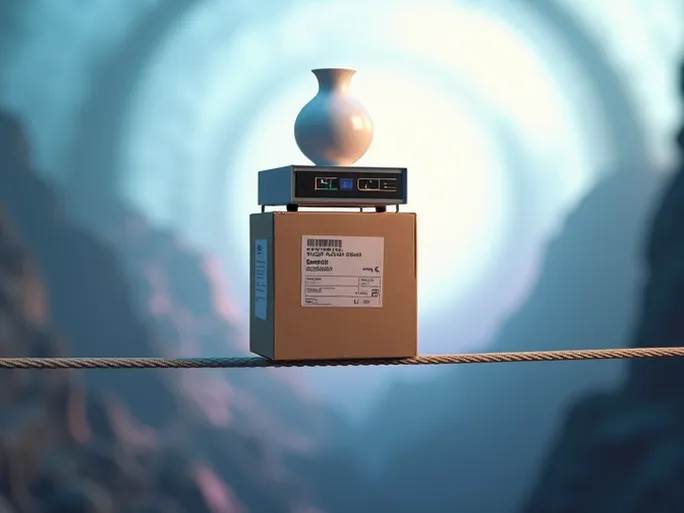

Risks in international shipping are omnipresent, with lost or damaged goods being a common occurrence. Shipping insurance, designed as a safety net for cargo protection, can become an unnecessary expense if purchased without understanding its limitations. When does international shipment insurance make financial sense, and what alternatives exist?

This analysis examines appropriate scenarios for shipping insurance, its hidden limitations, and alternative risk management strategies to help shippers make informed decisions.

Risk Assessment: Evaluating Cargo and Route Variables

The decision to purchase shipping insurance requires careful consideration of multiple factors, including cargo value, physical characteristics, and destination-specific risks.

- High-value items: Luxury goods, jewelry, or precision instruments warrant full coverage. The premium cost becomes justified when weighed against potential significant financial losses.

- Low-value standardized goods: For inexpensive, mass-produced items shipped via reliable routes with low damage rates, skipping insurance may optimize logistics costs—provided the shipper can absorb potential losses.

- Fragile items: Insurance claims for breakage often get denied due to "improper packaging." Shippers must ensure compliance with international packaging standards and use protective materials like bubble wrap or cushioning fillers before considering insurance.

- Battery-containing goods: Products with lithium batteries require proper safety documentation (like MSDS reports). Without these, insurance coverage becomes void regardless of payment.

- High-risk routes: Destinations with strict customs, frequent labor strikes, or poor infrastructure increase risks of inspection delays or rough handling. Insurance becomes particularly valuable for these routes.

- Low-risk routes: Established trade lanes with efficient logistics networks present lower risks, potentially making full insurance coverage unnecessary.

The Fine Print: Understanding Coverage Limitations

Shipping insurance contains critical exclusions and calculation methods that frequently surprise claimants:

- Compensation methodology: Most carriers use the lower value between declared and actual worth, often deducting shipping fees before applying damage percentages. Over-declaring creates sunk costs, while under-declaring results in inadequate reimbursement.

- Exclusion clauses: Standard policies exclude force majeure events like customs seizures, wars, or strikes. Special categories like artwork or confidential documents typically lack coverage regardless of insurance purchase.

Alternative Risk Management Strategies

Third-party solutions sometimes offer superior protection compared to standard carrier insurance:

- Third-party transit insurance: These policies frequently cover risks excluded by carrier insurance, including political instability or natural disasters. Verification of full-transit coverage remains essential.

- Specialized logistics providers: Some niche carriers include high compensation guarantees as standard features, potentially eliminating separate insurance needs. Provider reputation and claim transparency require thorough vetting.

Strategic Recommendations

Effective shipping insurance serves to mitigate high-probability, high-impact risks rather than providing psychological comfort. Decision-makers should conduct comprehensive evaluations of cargo vulnerability, route reliability, and policy terms before committing.

Given fluctuating international shipping rates, consultation with logistics specialists and comparative pricing analysis through digital platforms can optimize both protection levels and transportation costs.

All policy interpretations derive from industry standards—actual carrier terms govern specific claims.