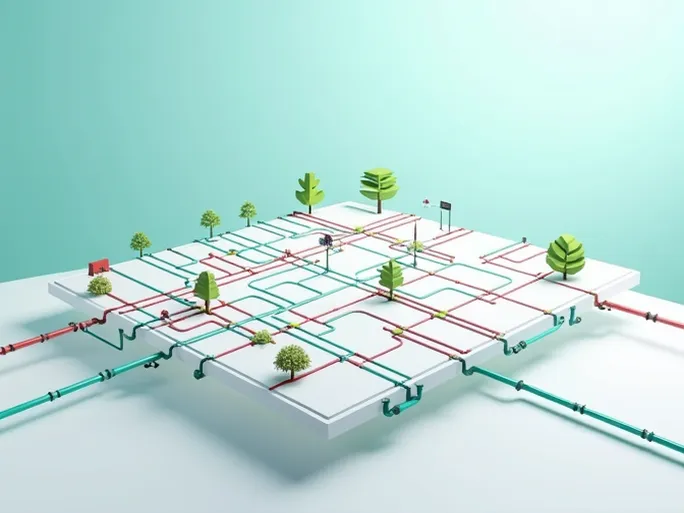

If global supply chains operate like precision machinery, then cash flow serves as the lifeblood that keeps this system functioning. When circulation falters, business growth faces severe constraints. Have you ever been misled by the superficial "low interest rates" advertised by banks? Or found yourself confused by the hidden costs in fixed-fee commercial loans? How can e-commerce businesses maintain growth during cash flow shortages?

Bank Loan Rates: The Truth Behind "Low Interest" Offers

When promoting loan products, banks often emphasize their "low interest rates," but businesses should beware—these may simply serve as bait. Actual interest rates are influenced by multiple factors including credit ratings, collateral value, loan terms, and market rate fluctuations. Justin Sherlock, a supply chain and fintech expert with over a decade of experience in investment, banking, and startup scaling, advises companies to thoroughly review loan agreements before applying, understand all fees and terms, and conduct comprehensive comparisons to select the most suitable financing option.

Fixed-Fee Commercial Loans: Watch for Hidden Costs

While fixed-fee commercial loans appear straightforward, they often conceal various charges such as processing fees, appraisal costs, and legal expenses. These additional fees can significantly increase the actual cost of financing. Sherlock emphasizes that businesses must carefully evaluate all potential charges when considering fixed-fee loans and maintain clear communication with lenders to ensure full transparency regarding total costs.

E-Commerce Cash Flow Management: The Lifeline of Growth

For e-commerce businesses, cash flow represents the critical factor sustaining growth. During periods of financial strain, companies need to implement proactive measures to improve liquidity, including inventory optimization, shortening collection cycles, and extending payment terms. Sherlock recommends establishing robust cash flow forecasting models to identify potential issues early and implement appropriate countermeasures. Additionally, businesses may consider external financing options such as bank loans or equity investment to alleviate cash flow pressures.

With his extensive industry expertise, Justin Sherlock provides comprehensive supply chain financial solutions to help businesses navigate the complex financial impacts of global supply chains and achieve success in international markets.