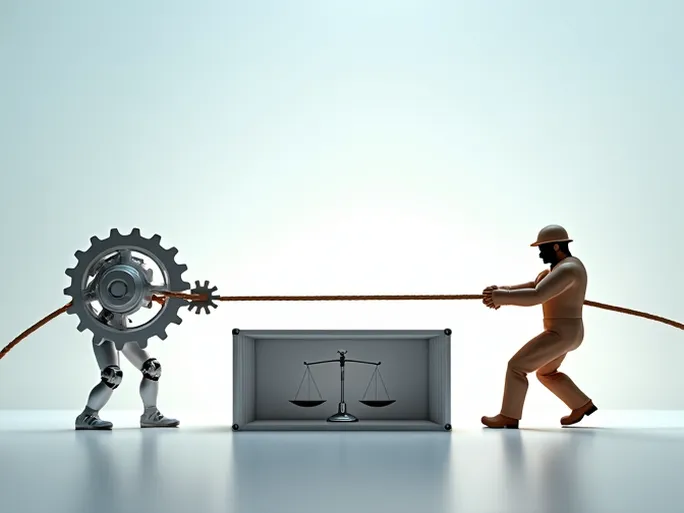

The debate over automation—whether it serves as an engine for efficiency or a driver of worker displacement—has once again pushed negotiations between the International Longshoremen's Association (ILA) and the United States Maritime Alliance (USMX) to the brink of collapse. After a brief strike in October, both parties attempted to restart talks this week regarding a new master contract agreement. However, USMX's shifting stance on automation has further strained already tense relations. With just two months remaining until the January 15 deadline, failure to reach an agreement risks another disruption at ports along the U.S. East Coast and Gulf Coast, potentially delivering another blow to global supply chains.

Negotiations: A Looming Deadline

The master contract between ILA and USMX covers multiple critical ports along the U.S. East Coast and Gulf Coast, directly impacting the working conditions and wages of tens of thousands of dockworkers. The previous agreement expired on September 30, 2024, but after both sides agreed to extend negotiations, the new deadline was set for January 15, 2025. However, significant disagreements on key issues have left the prospects of a deal uncertain.

Automation: The Breaking Point

Automation has long been a contentious issue between ILA and USMX. According to the ILA, USMX initially pledged not to introduce full or semi-automation into negotiations but later reversed its position, proposing the implementation of semi-automated systems. The ILA has expressed strong opposition, accusing USMX of reneging on its commitments. In a statement posted on its official Facebook account, the union clarified that while it supports automation technologies that enhance safety and efficiency, it insists that human operators must retain control. In other words, the ILA opposes any automation that could lead to job losses.

USMX, however, argues that its goal is not to replace workers but to improve port safety and throughput capacity through new technologies. The alliance contends that the ILA's resistance is overly conservative and could hinder the industry’s ability to meet future supply chain demands. USMX also pointed out that some ports have been using automation for nearly two decades, suggesting that the ILA’s stance represents a step backward.

Industry Reactions: Growing Concerns

The breakdown in talks has drawn sharp reactions from trade groups. The American Apparel & Footwear Association (AAFA) expressed disappointment in a LinkedIn post, noting that the October strike had already caused weeks of delays and backlogs, negatively affecting employment and global shipping networks. The AAFA urged both sides to return to the negotiating table and reach an agreement to ensure stable port operations.

Understanding Automation: Definitions and Types

To better grasp the dispute, it is essential to define automation in the context of port operations. Automation typically refers to the use of robotics, computer-controlled systems, and other technologies to perform tasks traditionally handled by humans. Based on the degree of automation, it can be categorized as follows:

- Manual Operation: All tasks are performed by workers without automation.

- Assisted Automation: Automated equipment supports human labor (e.g., cranes operated by workers).

- Semi-Automation: Partial automation with human oversight (e.g., automated guided vehicles requiring manual loading/unloading).

- Full Automation: Entirely automated systems with no human intervention.

Pros and Cons of Automation

Automation offers clear advantages in efficiency, cost reduction, and safety but also raises concerns about job losses and implementation challenges.

Advantages:

- Increased operational efficiency and 24/7 productivity.

- Lower labor and maintenance costs over time.

- Enhanced safety by reducing manual handling risks.

- Improved precision in cargo handling and logistics.

- Optimized resource allocation (e.g., smart stacking in container yards).

Disadvantages:

- Potential job displacement, particularly for low-skilled workers.

- High upfront investment in technology and infrastructure.

- Technical vulnerabilities leading to operational disruptions.

- Cybersecurity threats targeting automated systems.

- Broader socioeconomic impacts, including income inequality.

ILA’s Stance: Conditional Acceptance

The ILA does not reject automation outright but insists on safeguards for workers. Key demands include:

- Job protection through retraining and redeployment programs.

- Profit-sharing from automation-driven efficiency gains.

- Rigorous safety evaluations for automated systems.

- Preservation of collective bargaining rights.

USMX’s Perspective: Technological Progress

USMX views automation as inevitable for maintaining competitiveness. Its arguments include:

- Automation aligns with global trade growth and industry trends.

- Enhanced efficiency strengthens U.S. ports against international rivals.

- New jobs in tech maintenance and data analysis could offset losses.

- Automation improves workplace safety by minimizing hazardous tasks.

Potential Compromises

To resolve the impasse, both sides could explore:

- Phased automation to allow workforce adaptation.

- Joint funding for worker retraining initiatives.

- Standardized safety and operational protocols for automation.

- Enhanced labor-management dialogue to build trust.

Supply Chain Implications

A failure to reach an agreement by January 15 risks renewed port disruptions, exacerbating delays, raising shipping costs, and further straining fragile global supply chains. Given current economic uncertainties, prolonged negotiations could hinder recovery efforts.

Conclusion

Automation is an irreversible trend in port operations, but its implementation requires balancing efficiency gains with workforce protections. The ILA and USMX must move beyond adversarial positions and collaborate on solutions that serve both industry growth and worker interests. Without compromise, the dispute threatens to destabilize U.S. ports and ripple across international trade networks.