China's transportation market has become increasingly competitive as the number of carriers continues to grow. Freight forwarders, acting as contractual carriers, play a crucial role in this landscape. To secure more cargo, many carriers resort to slashing freight rates, extending payment terms, or even entering unfavorable contracts with less reputable shippers or forwarders. While these tactics might provide short-term gains, they significantly increase market risks and leave many carriers struggling to collect payments.

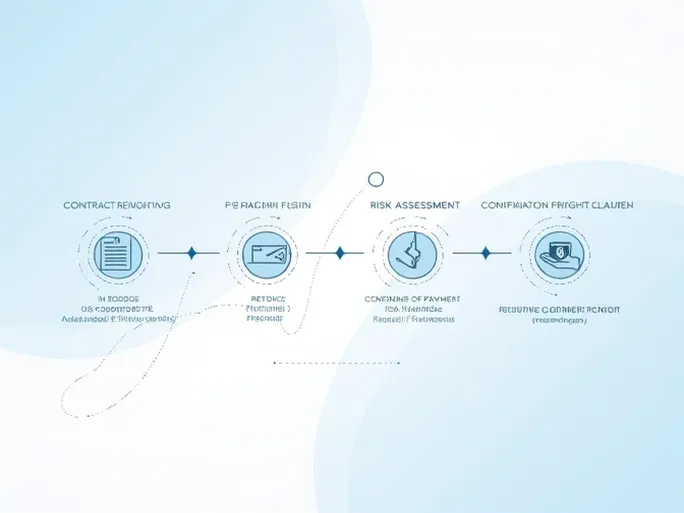

I. The Positioning and Risk Assessment of Prepaid Freight Clauses

In contracts between carriers and shippers, prepaid freight (PP) clauses serve as critical protective measures. These provisions require charterers to pay freight charges before cargo loading and bill of lading issuance. While theoretically designed to safeguard carriers' financial interests, operational complexities often delay payments until days after bill issuance, exposing carriers to significant risks.

1. Potential Risks in Freight Payment

After cargo loading, unforeseen circumstances like severe weather, cargo damage, or maritime accidents may lead to cargo loss. If charterers haven't paid freight charges when such incidents occur, standard contract terms typically prevent carriers from recovering these fees. This leaves carriers bearing both transportation risks and financial losses.

2. Risk Mitigation Strategies

To address these vulnerabilities, carriers should incorporate explicit contract language such as: "Freight shall be paid unconditionally upon cargo loading, regardless of subsequent loss or damage." Such provisions help secure carriers' legitimate rights and ensure freight payment even in cases of cargo loss.

II. Challenges and Solutions Regarding Bona Fide Bill Holders

In international shipping, bills of lading serve both as contractual documents and symbols of cargo ownership. The existence of bona fide bill holders presents new challenges for freight collection, as carriers who fail to collect payments cannot legally claim against these third parties. Clarifying rights and obligations between carriers and bill holders therefore becomes essential.

1. Legal Status of Bona Fide Bill Holders

Bona fide bill holders enjoy priority claim rights under law, restricting carriers' ability to seek payment from them when original shippers default. This legal framework underscores the importance of securing payments before releasing bills of lading.

2. The Need for Shorter Payment Cycles

Carriers should negotiate shorter payment terms when drafting contracts and prioritize working with reputable, financially stable charterers. Thorough due diligence on potential partners can significantly reduce fraud risks and improve collection efficiency.

III. Identifying the Freight Payer: A Critical Factor

In complex shipping arrangements, clearly identifying the responsible payment party is crucial for risk management. While traditional theory holds that the bill's shipper should pay prepaid freight, actual practice—particularly in liner shipping—often involves freight forwarders or other principals as payers.

1. Confirming the Actual Payer

In liner operations, carriers should issue invoices to the party designated in booking requests (shipping orders) to clarify obligations and improve collection. For charter parties, the contract explicitly identifies the charterer as the payer.

2. Risk Control Measures

Contracts should unambiguously specify payment responsibilities to avoid delays. Additional safeguards include regular client communication, transparent contracting, and adopting digital freight management tools to streamline collections.

IV. Conclusion and Future Outlook

To navigate today's competitive market, carriers must implement robust strategies against payment risks. Strengthening contract terms, verifying payers, and cultivating relationships with creditworthy clients can significantly mitigate collection challenges.

Looking ahead, intelligent, data-driven transportation management systems will offer innovative solutions. Leveraging AI and big data for credit assessments and risk prediction will enhance operational efficiency. Staying attuned to market and regulatory developments while continuously improving services will position carriers for sustainable success in this evolving landscape.