As the global economy continues its gradual recovery, China's export container shipping market has emerged as a focal point for its remarkably stable and positive performance. In July 2024, the sector demonstrated exceptional resilience in facing multiple challenges, with strong transportation demand and balanced supply-demand dynamics serving as powerful engines for foreign trade development.

According to the latest data from China's General Administration of Customs, the country's dollar-denominated exports in June grew by 8.6% year-on-year, exceeding market expectations. This growth not only contributed to the continuous expansion of foreign trade but also laid a solid foundation for the stable development of the container shipping market.

Rising Freight Rates Reflect Market Strength

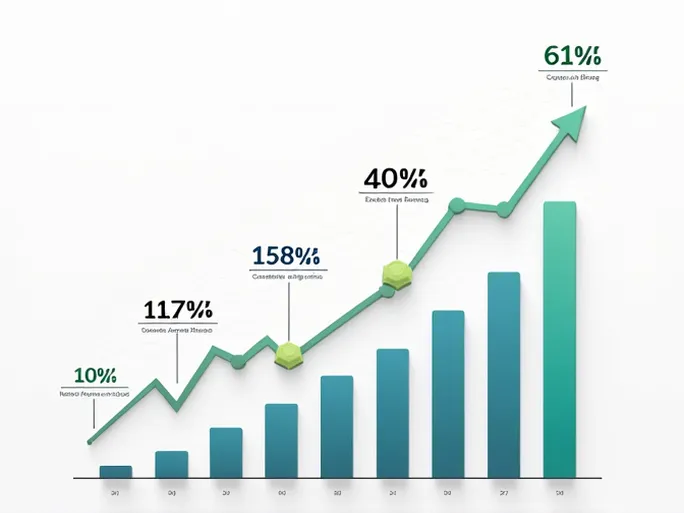

Data from the Shanghai Shipping Exchange reveals that China's export container composite freight index reached 2,107.66 points in July 2024, marking a 19.1% increase from the previous month. The average spot market index rose to 3,599.74 points , up 4.7% month-on-month. These figures indicate that the overall freight market maintains an upward trajectory, providing stability for major shipping routes.

Port Throughput Maintains Steady Growth

China's major ports maintained normal operations in June 2024, with container throughput showing stable growth. The country's ports handled a total of 29 million TEUs , representing a 6.9% year-on-year increase. Coastal ports performed particularly well, handling 25.59 million TEUs ( +8.0% YoY), while river ports demonstrated resilience despite a slight 0.3% decline.

The charter market has mirrored this activity, with Clarksons Research reporting across-the-board rate increases for various vessel types in July. 2,750 TEU vessels saw rates rise by 10.6% , while 4,400 TEU , 6,800 TEU , and 9,000 TEU vessels recorded increases of 7.8% , 6.4% , and 10.0% respectively.

Regional Route Performance Varies

The Europe and Mediterranean routes maintained strong demand but experienced slower freight rate growth due to the Eurozone's preliminary July composite PMI of just 50.1 . China-Europe freight rates averaged $4,975/TEU ( +29.9% ), while Mediterranean rates reached $5,372/TEU ( +14.5% ).

In contrast, North American routes showed signs of softening, with the Markit manufacturing PMI dropping to 49.5 . Despite initial resilience, westbound and eastbound U.S. routes from China saw average rate increases of 19.2% and 19.1% respectively by mid-July.

South American routes remained strong, with the July freight index averaging 1,797.80 points , up 18.0% month-on-month. The Persian Gulf and Red Sea (PGR) routes showed minimal fluctuation at 2,238.41 points ( +0.1% ), while Japan routes saw a modest 6.3% increase to 772.67 points .

Market Outlook and Strategic Considerations

The July 2024 data reveals an uneven but generally positive performance across China's export container shipping routes. Shipping companies must maintain flexibility to adapt to external economic fluctuations while focusing on service quality, operational efficiency, and risk management.

Despite challenges, China's shipping market continues to demonstrate resilience and potential within the global economic recovery. Innovative service models, market adaptability, and deep industry insights will be crucial for sustaining growth in this dynamic environment.

Industry participants remain committed to evolving with market trends, addressing challenges, and seizing opportunities to provide high-quality, efficient shipping services that support China's foreign trade development and contribute to global commerce.