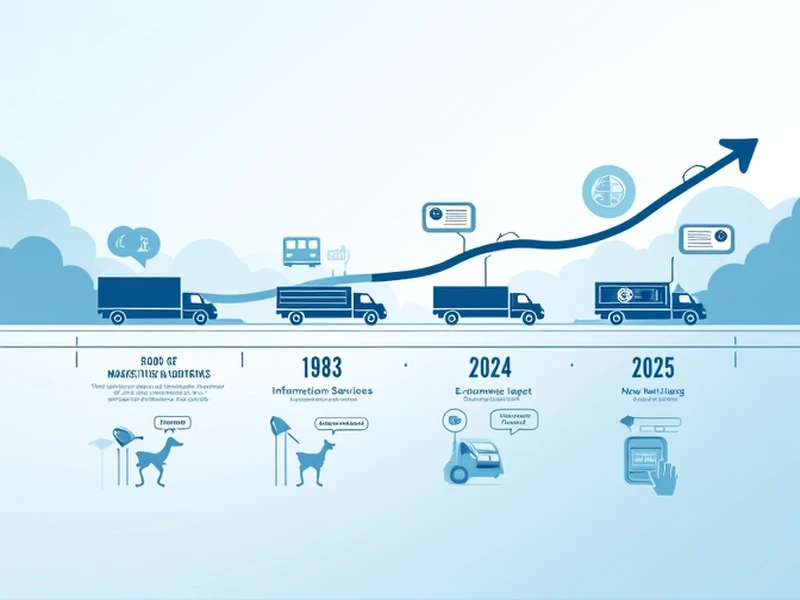

01 Historical Review of LTL Logistics Development

As one of China's earliest liberalized industries, road-based Less-than-Truckload (LTL) logistics has undergone four critical developmental phases. During the planned economy era prior to 1983, state-owned transport companies monopolized the highway freight market, resulting in capacity shortages and inefficient operations. The initial marketization phase beginning in 1983 saw government deregulation that allowed numerous private operators to enter the market. While this solved capacity issues, it also triggered intense homogeneous competition and price wars. By 1988, freight matching services emerged, utilizing information platforms to reduce empty runs and improve efficiency. In recent years, the rise of e-commerce and new retail models has accelerated LTL's displacement of traditional full truckload services, with industry consolidation producing dominant players like SF Express, Kuaiyue Logistics, and ANE Logistics through rapid expansion.

02 Current State of the LTL Industry (2024)

In 2024, despite strong e-commerce demand and improved market conditions driving logistics sector recovery, China's road LTL market remains surprisingly stagnant. Transaction activity concentrates in smart logistics and IT solutions. While the broader market shows growth, leading LTL enterprises including SF Express and Kuaiyue Logistics report sluggish sub-9% growth rates. The industry faces pressing transformation needs across multiple fronts: regionalization versus specialized routes, customized value-added services, and the imperative of smart logistics and green initiatives.

03 Anticipated Changes in 2025's LTL Market

The market environment increasingly impacts China's fragmented LTL sector dominated by small specialized operators. Economic restructuring and intensifying competition have made specialized line-haul operations particularly challenging. Emerging in 2025 are innovative players like Dajitongyun and Ronghui Logistics, focusing on large-volume LTL segments with distinctive operational models. Dajitongyun optimizes regional franchise networks and route efficiency, while Ronghui combines network franchising with direct management to enhance operational performance.

04 Future Directions for LTL Specialized Routes

Confronting destructive price competition, LTL operators must urgently explore new strategies. Both cost compression and service homogenization disadvantage specialized route providers. To differentiate, companies should strengthen market positioning, develop differentiated services, and accelerate digital transformation. Case studies like Huaao Logistics' internet furniture supply chain, Zhisheng Supply Chain's exhibition collaborations, and Jinxing Supply Chain's warehouse management upgrades demonstrate the importance of innovation and integration.

05 Epilogue: Market Forces Driving Rapid LTL Transformation

China's LTL sector, constrained by small scale and limited technical/marketing capabilities, commonly suffers from single-product operations. Moving forward, specialized route operators must exit comfort zones by monitoring market shifts and customer needs, employing precise positioning and differentiated strategies to enhance competitiveness. Only through such measures can they withstand intensifying industry competition. Ultimately, the sector's future hinges on agile market response, service innovation, and strengthened alliances between enterprises.