Less than Container Load (LCL) shipping refers to the method of consolidating goods from multiple shippers into a single container for transportation. This approach not only reduces freight costs but also enhances shipping efficiency, particularly beneficial for importers and exporters with smaller cargo volumes. However, the customs clearance process for LCL shipments can be relatively complex, making it essential to understand the relevant procedures. This article provides a detailed explanation of the customs clearance process for LCL cargo to help shippers and agents complete operations successfully.

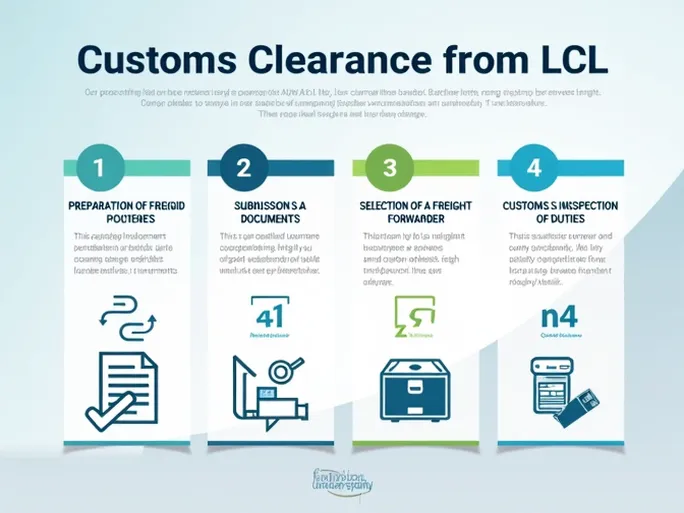

1. Preparing the Cargo Manifest

Before initiating LCL shipping, the shipper or their agent should prepare a detailed cargo manifest. This document must include comprehensive information about each item:

- Description: Clear specifications of the goods, including their purpose and characteristics.

- Quantity: The exact number of units for each product.

- Value: The declared value of each item, typically sourced from commercial invoices.

- HS Code: The Harmonized System classification code, which determines applicable tariffs and regulatory policies.

The accuracy of the cargo manifest is critical, as any errors or omissions may lead to customs delays or additional charges.

2. Submitting Commercial Invoices and Packing Lists

In addition to the cargo manifest, shippers must prepare commercial invoices and packing lists:

- Commercial Invoice: Contains seller and buyer information, product descriptions, quantities, prices, and payment terms. This document serves as the official proof of value for customs assessment.

- Packing List: Details the packaging arrangement, including the location and quantity of items within the container, facilitating customs verification during spot checks.

Ensuring these documents are precise and complete can significantly streamline subsequent clearance procedures.

3. Selecting a Professional Customs Broker

LCL shipments typically require the expertise of freight forwarders or customs brokers who understand regulatory requirements and can navigate clearance processes efficiently. When selecting an agent, shippers should consider:

- Experience: Prioritize brokers with extensive LCL shipping expertise for better customs communication.

- Reputation: Review client testimonials and industry standing to evaluate service quality.

- Transparent Pricing: Clarify fee structures and potential additional charges to avoid financial disputes.

4. Document Submission and Duty Payment

After verifying all documentation, the broker submits required materials to customs authorities, including:

- Cargo manifest, commercial invoice, and packing list

- Transportation documents such as bills of lading or waybills

Customs will calculate applicable duties and taxes based on the HS codes and declared values. Timely payment is crucial to prevent cargo holds or processing delays.

5. Customs Inspection

Customs agencies may conduct random inspections of LCL shipments to verify documentation accuracy and cargo compliance. Discrepancies may trigger comprehensive examinations or penalties. Maintaining open communication with customs officials enables brokers to promptly address inquiries or provide clarifications.

6. Cargo Release and Retrieval

Following successful clearance, customs authorities will release the goods for delivery to designated warehouses. To claim shipments, shippers or agents must present:

- Customs release documentation

- Cargo manifest

7. Conclusion

As customs procedures vary across jurisdictions, partnering with experienced freight forwarders remains essential for seamless LCL clearance. In LCL shipping operations, thorough preparation and effective communication serve as critical success factors, enabling businesses to capitalize on international trade opportunities while maintaining operational efficiency.