Customs duty exemption codes play an indispensable role in international trade and customs management, serving as crucial administrative tools for implementing customs collection and tax reduction policies. These codes provide a clear framework for customs operations including taxation, supervision, management, and policy enforcement, while supporting the effective functioning of automated declaration systems and Electronic Data Interchange (EDI) clearance systems.

This classification system not only helps streamline customs procedures and improve import-export efficiency but also provides valuable data for tariff analysis and decision-making.

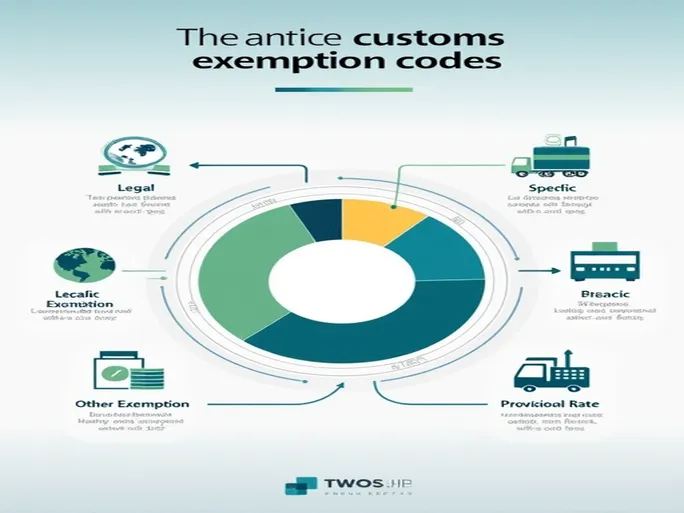

Classification Structure

Customs duty exemption codes are primarily divided into five categories: statutory taxation, statutory duty reduction, specific duty reduction, other duty reductions, and provisional tariff rates. This classification system ensures different types of goods and trade activities receive appropriate treatment and supervision according to national laws and regulations.

The codes consist of three digits, with the first digit representing the category and the subsequent two digits indicating the specific sequence of duty reduction items within that category, facilitating classification and retrieval.

Statutory Taxation

In the statutory taxation category, general import-export goods are subject to customs duties and value-added taxes as stipulated by national laws. Processing these goods is relatively straightforward, typically not involving complex duty reduction policies, ensuring customs can effectively collect taxes according to established standards. This not only safeguards national fiscal stability but also provides businesses with predictability in international trade.

Statutory Duty Reduction

Statutory duty reductions apply to specific goods or trade circumstances as defined by law. For instance, certain public welfare-related materials may qualify for duty reductions to promote social welfare and public interest development. Such measures help reduce costs for businesses and foster enterprise growth.

Specific Duty Reductions

For specific duty reductions, customs further categorizes eligible recipients based on region, purpose, trade nature, enterprise type, and funding sources. In special economic zones like Shenzhen and Zhuhai, for example, imported self-use materials and exported goods may qualify for duty and VAT refunds within state-approved quotas. These policies aim to encourage foreign and local business development, boosting regional economic prosperity.

Specific reductions may also apply to particular industries and uses. Equipment and materials for high-tech industries or energy-saving environmental protection projects, for instance, may qualify for state tax incentives. Such policies not only enhance national industrial competitiveness but also support green economic development.

Other Duty Reductions

Other statutory duty reductions encompass measures not included in the aforementioned categories. These often apply to import-export goods meeting specific conditions, such as food and pharmaceuticals, which may qualify for special reduction policies under particular circumstances. This diversified policy design ensures various goods and businesses can access appropriate tax benefits, promoting overall economic health.

Data Analysis and Modern Trade

In modern international trade, customs duty exemption codes also provide a foundation for data analysis. Tariff databases relying on these codes enable real-time monitoring and analysis, helping customs administrators and policymakers develop more reasonable taxation policies and supervision measures. Businesses using these codes for customs declarations can significantly reduce costs and improve efficiency. Proper application helps avoid tax losses from misclassification during declaration processes.

In conclusion, thoroughly understanding and applying customs duty exemption codes is crucial for improving import-export efficiency, reducing tax burdens, and optimizing trade processes. In today's globalized economy, businesses must stay informed about customs policy changes and strategically use these classifications to navigate market challenges. Mastering these codes positions companies for success in international competition, promoting sustainable development and maximizing economic benefits. Effective application not only enhances clearance efficiency but also contributes to national trade prosperity.