In today's global financial landscape, international wire transfers have become a common method for individuals and businesses to move funds across borders. However, as markets grow increasingly interconnected, the complexity of cross-border transactions has also risen—particularly when it comes to ensuring both security and timely delivery of funds. One of the most crucial steps in this process is selecting the correct SWIFT code.

Understanding SWIFT Codes

A SWIFT code, also known as a Bank Identifier Code (BIC), is a unique alphanumeric sequence used to identify specific banks and financial institutions in international transactions. When sending money overseas, providing the correct SWIFT code is essential to guarantee that funds reach the intended destination. For instance, when transferring money to the Fédération des caisses Desjardins du Québec —one of Canada's largest cooperative financial groups—using its accurate SWIFT code, CCDQCAMMXXX , is the first step toward a secure transaction.

The Fédération des caisses Desjardins du Québec operates under stringent security standards, offering a wide range of financial services. SWIFT, as the global standard for financial messaging, streamlines the transfer process while maintaining accuracy. Thus, verifying the correctness of a SWIFT code directly impacts both the safety and efficiency of a transaction.

Key Considerations for International Transfers

When initiating a wire transfer, it's imperative to confirm that the SWIFT code matches the recipient bank. For transfers to the Fédération des caisses Desjardins du Québec, the institution's address is 100 Rue des Commandeurs, Lévis, Québec, G6V 7N5, Canada . In addition to the SWIFT code, senders must provide the recipient's account details, residential information, and any additional required data to ensure a smooth and precise transaction.

Unfortunately, many individuals overlook the importance of double-checking SWIFT codes and related details. Errors in these identifiers can lead to delayed or misdirected funds, creating unnecessary complications and potential financial losses. Before finalizing any transfer, carefully verify the SWIFT code against the intended bank's official records.

Enhancing Transaction Security

To further safeguard international transactions, it's advisable to use reputable transfer channels. Most major banks and financial institutions offer dedicated support for wire transfers, including guidance on proper procedures. While online platforms provide convenient alternatives, users must confirm their legitimacy and security measures before proceeding.

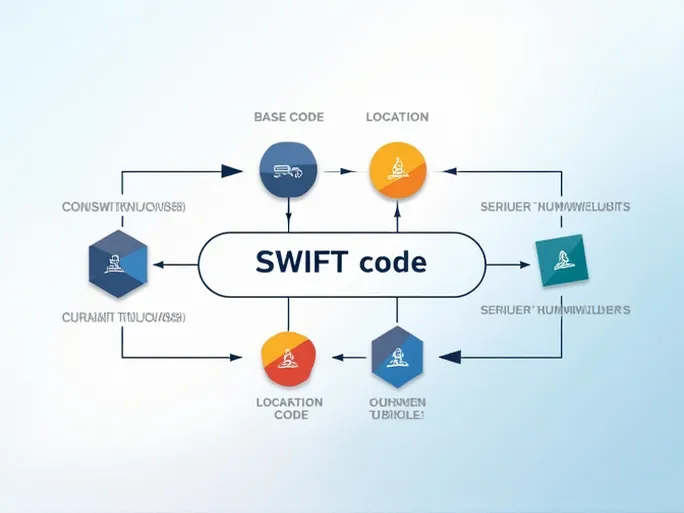

Understanding the structure of SWIFT codes can also aid in their proper use. These codes typically consist of 8 to 11 characters: the first four letters identify the bank, followed by a two-letter country code, a two-character location code, and an optional three-digit branch code. This standardized format enables financial systems to quickly and accurately route funds.

The Future of Cross-Border Payments

As financial technology advances, the speed and cost-effectiveness of international transfers continue to improve. Nevertheless, security remains paramount. By prioritizing the accuracy of SWIFT codes and associated information, senders can enhance efficiency while minimizing risks.

In an era of globalized finance, comprehending the intricacies of international transfers—especially the role of SWIFT codes—is essential for anyone managing cross-border payments. Taking the time to verify details such as the Fédération des caisses Desjardins du Québec's SWIFT code ( CCDQCAMMXXX ) ensures that funds arrive securely and without delay. With this knowledge, individuals and businesses can navigate the complexities of international finance with confidence.