In today's increasingly globalized world, international money transfers have become commonplace. Whether for personal remittances or large corporate transactions, accurate and efficient fund transfers are crucial. In this process, SWIFT/BIC codes serve as passports that ensure your money reaches its intended destination. But do you truly understand how to find and use these codes correctly? Let's explore this topic in depth to help you navigate international transfers with confidence.

Understanding SWIFT/BIC Codes

Before delving into SWIFT/BIC codes, it's important to understand the basics of international money transfers. In cross-border financial transactions, banks worldwide need a standardized system to identify and verify fund movements. The SWIFT (Society for Worldwide Interbank Financial Telecommunication) network was established for this purpose, with BIC (Bank Identifier Code) being its coding system. A SWIFT/BIC code typically consists of 8 to 11 alphanumeric characters that uniquely identify a specific bank and branch.

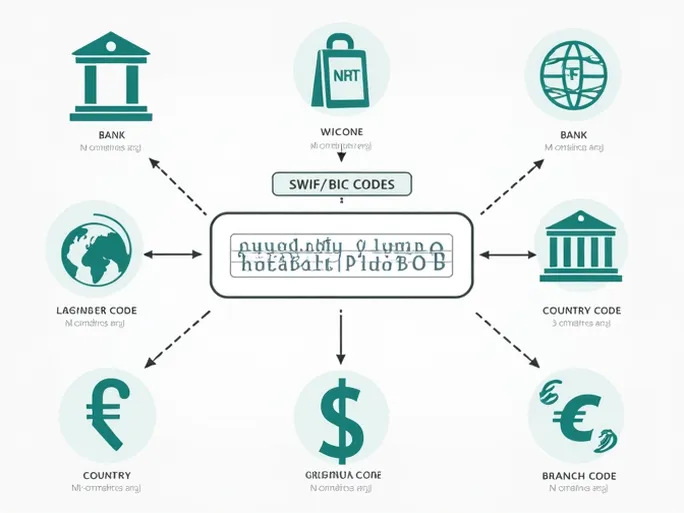

These codes aren't random combinations but contain specific information that helps recipient banks identify the sending institution, ensuring secure and efficient transactions. A typical SWIFT/BIC code like CCDQCAMMFID contains four key components:

- Bank code (CCDQ): Identifies the financial institution (e.g., FEDERATION DES CAISSES DESJARDINS DU QUEBEC)

- Country code (CA): Indicates the bank's location (Canada in this example)

- Location code (MM): Specifies the bank's headquarters location

- Branch code (FID): Identifies specific branches (XXX typically denotes the head office)

Practical Example: FEDERATION DES CAISSES DESJARDINS DU QUEBEC

For the institution "FEDERATION DES CAISSES DESJARDINS DU QUEBEC," the complete SWIFT/BIC details are:

- SWIFT code: CCDQCAMMFID

- Bank name: FEDERATION DES CAISSES DESJARDINS DU QUEBEC

- Branch name: [Specific branch if applicable]

- Address: 100 RUE DES COMMANDEURS, LEVIS

Ensuring Accurate International Transfers

Precise use of SWIFT codes is critical in international transfers. Even minor errors can cause failed transactions or misdirected funds. Consider these practical tips:

- Verify bank details: Ensure the recipient bank name matches exactly, as many institutions have similar names.

- Confirm branch information: For accounts at specific branches, use the corresponding SWIFT code. When uncertain, contact the recipient or bank directly.

- Check country codes: The SWIFT code's country designation must match the recipient bank's actual location to prevent irreversible errors.

- Use official sources: Always reference the bank's official website or contact them directly for the most current information, especially for large transfers.

Where to Find SWIFT/BIC Codes

Several reliable methods exist for obtaining correct SWIFT/BIC codes:

- Bank websites: Most financial institutions publish their SWIFT codes and international transfer guidelines online.

- SWIFT official platform: The SWIFT website maintains an authoritative database searchable by bank name and location.

- Bank customer service: Contacting the bank directly provides professional verification of codes.

- Recipient confirmation: Beneficiaries often know their bank's SWIFT code and can provide accurate information.

The Growing Importance of SWIFT/BIC Codes

As e-commerce expands and cross-border transactions multiply, SWIFT/BIC codes have become indispensable. They form the backbone of secure global finance, maintaining transparency and efficiency. Research indicates approximately 30% of international payments experience delays due to incomplete or incorrect information, highlighting the critical need for accurate SWIFT codes. For businesses, such errors can disrupt cash flow and operations.

Despite emerging fintech solutions, most international transactions still rely on the SWIFT network for security and reliability. Understanding these fundamentals empowers individuals and businesses to conduct seamless cross-border transactions.

Conclusion

SWIFT/BIC codes remain essential components of every international money transfer. With this knowledge, you can approach global transactions with greater confidence, ensuring your funds reach their destination securely and efficiently. In our interconnected financial landscape, attention to these details makes the difference between smooth transactions and costly complications. Mastering SWIFT/BIC codes transforms international transfers from daunting procedures into manageable financial activities.