In today's globalized economy, cross-border transactions and fund transfers have become essential activities for businesses and individuals alike. Among the critical components facilitating these international transfers is the SWIFT/BIC code system, particularly when dealing with major financial institutions like Standard Chartered Bank (Singapore) Limited. Understanding its SWIFT/BIC code—SCBLSG22EQI—is crucial for ensuring successful international money transfers.

Fundamentals of SWIFT/BIC Codes

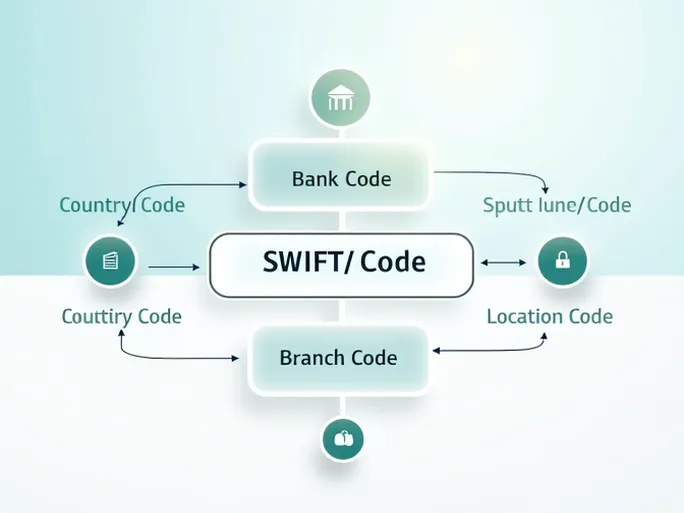

Before examining Standard Chartered Bank Singapore's specific code, it's important to understand the basic structure and significance of SWIFT/BIC codes in international banking. The SWIFT code (Society for Worldwide Interbank Financial Telecommunication) serves as an international standard for uniquely identifying banks and financial institutions worldwide. These codes typically consist of 8 to 11 characters with the following structure:

- Bank Code: 4 letters identifying the financial institution (e.g., "SCBL" for Standard Chartered Bank Singapore)

- Country Code: 2 letters indicating the bank's home country ("SG" for Singapore)

- Location Code: 2 characters specifying the bank's primary location ("22" for Standard Chartered Singapore)

- Branch Code: Optional 3 characters denoting specific branches ("XXX" typically represents the headquarters)

Decoding SCBLSG22EQI

The SWIFT/BIC code SCBLSG22EQI for Standard Chartered Bank Singapore breaks down as follows:

- Bank Code: SCBL - The unique identifier for Standard Chartered Bank

- Country Code: SG - Confirming the bank's Singapore registration

- Location Code: 22 - Indicating the bank's primary Singapore location

- Branch Code: EQI - Identifying a specific branch within the bank's network

Why SWIFT Codes Matter

Accuracy in SWIFT code usage is paramount for successful international fund transfers. Key reasons include:

- Preventing Delays: Incorrect codes can significantly delay transactions

- Minimizing Errors: Mistyped codes may route funds to wrong accounts, creating legal complications

- Ensuring Timely Delivery: Correct codes facilitate prompt transfers critical for business operations and personal finances

Best Practices for Secure International Transfers

When initiating SWIFT transfers, consider these safety measures:

- Verify all recipient details match official bank records

- Double-check SWIFT code accuracy before submission

- Maintain thorough transaction records

- Monitor accounts post-transfer for confirmation

SWIFT/BIC codes serve as invisible bridges in global finance, with Standard Chartered Bank Singapore's SCBLSG22EQI being a vital identifier for international transactions. Understanding these codes and implementing proper transfer protocols ensures efficient, secure movement of funds across borders.