In today's globalized world, international money transfers have become an indispensable part of life. Whether for individuals or businesses—facilitating cross-border transactions, purchasing assets, or supporting family abroad—the demand for international remittances continues to rise. Yet, many face challenges due to unfamiliarity with the process or operational errors, leading to delays, lost funds, or the need for resending. This is where the importance of SWIFT/BIC codes becomes evident, particularly for institutions like STANDARD CHARTERED BANK (SINGAPORE) LIMITED, whose code SCBLSG22WMO is a critical element in ensuring seamless transactions.

Understanding SWIFT/BIC Codes

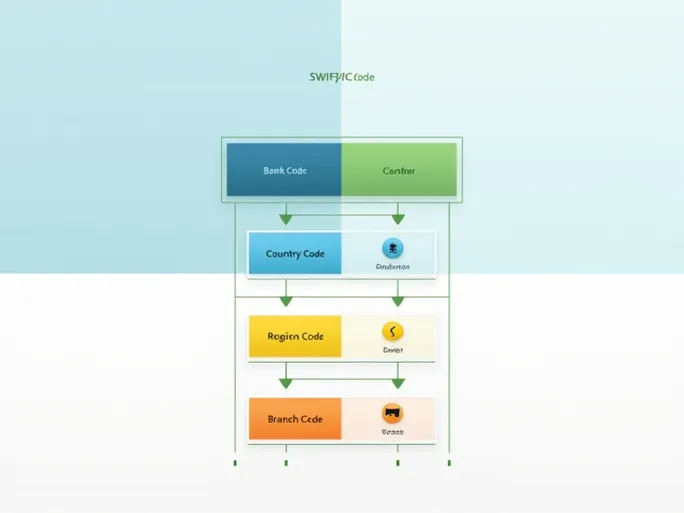

A SWIFT/BIC code (Society for Worldwide Interbank Financial Telecommunication/Bank Identifier Code) serves as the financial world's "ID card." It is a standardized format used globally to identify banks and financial institutions, enabling smooth and efficient cross-border transfers. Typically comprising 8 to 11 characters, the code pinpoints the specific bank and branch involved.

Breaking Down the SWIFT/BIC Structure

Examining the code SCBLSG22WMO reveals its components:

- Bank Code (SCBL): The first four characters identify STANDARD CHARTERED BANK (SINGAPORE) LIMITED.

- Country Code (SG): The next two characters denote Singapore, the bank's home country.

- Location Code (22): This segment specifies the bank's primary city or region.

- Branch Code (WMO): The final three characters indicate a specific branch. "XXX" typically represents the bank's headquarters.

This structured approach ensures accuracy and reliability in international transactions.

Key Considerations for International Transfers

Before initiating a transfer, verifying the SWIFT/BIC code is paramount. Here are essential steps to follow:

- Confirm Bank Details: Cross-check the recipient's bank name against the SWIFT code to ensure consistency.

- Verify Branch Information: If a specific branch code is required, confirm it matches the recipient's actual branch to prevent delays.

- Validate Country Code: Ensure the code aligns with the recipient bank's country to avoid misrouting.

Optimizing International Transfers

Selecting a reputable service can enhance the efficiency of cross-border payments. Such platforms often offer competitive exchange rates and lower fees compared to traditional banks, maximizing the value of transferred funds.

Advantages of Modern Transfer Services

- Transparent Fees: Clear disclosure of all charges upfront helps users make informed decisions.

- Speed: Many services process transfers within the same business day, addressing urgent financial needs.

- Support: Round-the-clock assistance ensures help is available whenever required.

Staying Updated on SWIFT/BIC Changes

Financial institutions occasionally update their SWIFT/BIC codes. Subscribing to bank notifications or verifying codes before each transfer mitigates risks of delays or misdirected funds.

Risks of Incorrect Codes

An erroneous SWIFT/BIC code can divert funds to unintended recipients, complicating recovery efforts—especially in cross-border scenarios. Vigilance in double-checking details is the best defense against such pitfalls.

Conclusion

Navigating international transfers requires precision, with SWIFT/BIC codes serving as the linchpin for success. For transactions involving STANDARD CHARTERED BANK (SINGAPORE) LIMITED, the code SCBLSG22WMO is indispensable. Coupled with reliable transfer services, users can achieve seamless global transactions. By prioritizing accuracy and staying informed, individuals and businesses can harness the full potential of international banking with confidence.