Have you ever experienced delays or misdirected funds when sending money internationally due to incorrect banking details? In today’s globalized business environment, correctly understanding and using SWIFT codes is essential, especially in financial hubs like Singapore. This article focuses on the SWIFT/BIC code for STANDARD CHARTERED BANK (SINGAPORE) LIMITED ( SCBLSG22WMO ) and highlights key considerations for seamless cross-border transactions.

What Is a SWIFT Code?

A SWIFT code, also known as a Bank Identifier Code (BIC), is a unique 8- to 11-character identifier that ensures accurate routing of funds between banks worldwide. For STANDARD CHARTERED BANK (SINGAPORE) LIMITED, the SWIFT code is SCBLSG22WMO . This code helps international banks clearly identify the sending and receiving institutions involved in a transaction.

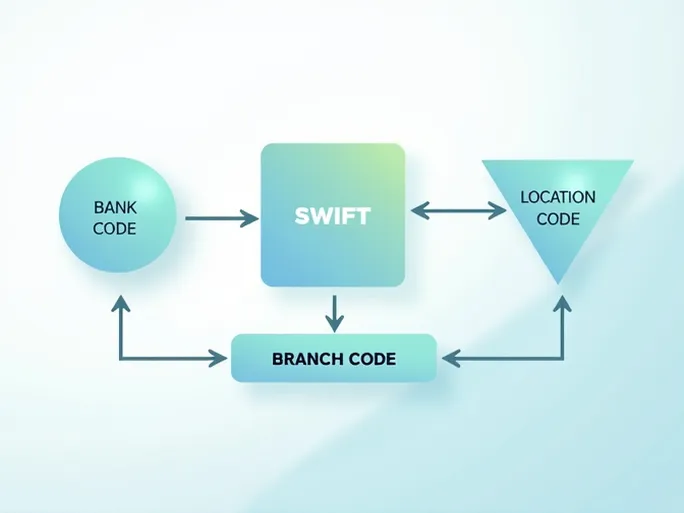

Breaking Down the SWIFT Code

Understanding the structure of a SWIFT code is crucial for secure and timely transactions. The code SCBLSG22WMO can be dissected into four key components:

- Bank Code (SCBL) : The first four letters represent STANDARD CHARTERED BANK, serving as its unique identifier in global finance.

- Country Code (SG) : The next two letters indicate the bank’s location in Singapore, ensuring compliance with national financial regulations.

- Location Code (22) : These two digits specify the bank’s primary branch or headquarters.

- Branch Code (WMO) : The final three characters denote a specific branch. If the code ends with "XXX," it typically refers to the bank’s main office.

Using the correct SWIFT code is critical to avoid delays or misdirected funds, particularly for high-value transactions. Always verify the details before initiating a transfer.

When to Use the SWIFT Code

The code SCBLSG22WMO should be used whenever sending funds to STANDARD CHARTERED BANK (SINGAPORE) LIMITED, whether for personal or business purposes. Confirm the latest SWIFT code through the bank’s official website or customer service to ensure accuracy.

Additionally, larger transactions may require extra verification steps. Proper use of the SWIFT code ensures swift and secure delivery of funds.

Tips for Smooth International Transfers

Follow these practical recommendations for hassle-free cross-border payments:

- Double-Check Details : Verify all recipient information, including the SWIFT code, before submitting a transfer request.

- Understand Fees : Be aware of transaction fees and exchange rates to avoid unexpected charges.

- Use Secure Channels : Always transfer funds through authorized banking platforms to safeguard your money.

By understanding the role of SWIFT codes and STANDARD CHARTERED BANK (SINGAPORE) LIMITED’s specific identifier, you can navigate international transactions with confidence. Whether for personal or business needs, attention to these details enhances efficiency and minimizes risks. For further clarification, consult your financial institution directly.