In today's globalized economy, international money transfers have become an essential part of daily life for many individuals and businesses. Whether for commercial transactions or personal remittances, understanding how to use SWIFT/BIC codes is crucial for ensuring secure and efficient fund transfers. This article explores the structure and usage of SWIFT/BIC codes, key considerations when sending money to the Central Bank of Paraguay, and the advantages of using Xe for international transfers.

The Structure of SWIFT/BIC Codes

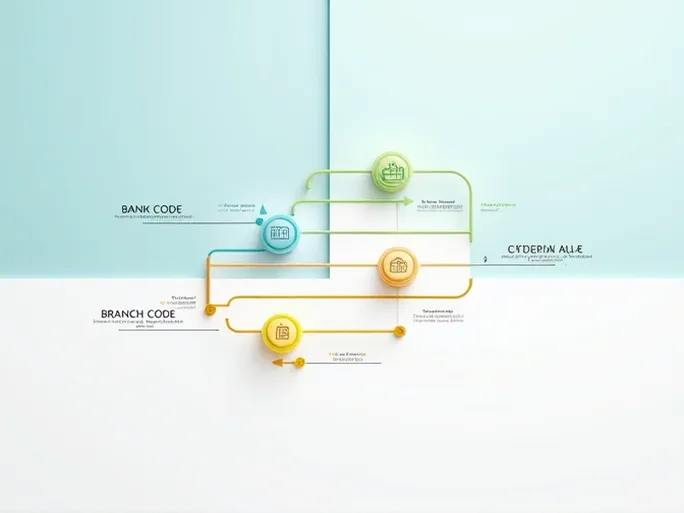

The SWIFT (Society for Worldwide Interbank Financial Telecommunication) system is a network-based platform that enables banks and financial institutions to conduct cross-border transactions. A SWIFT/BIC (Bank Identifier Code) is a unique code used to identify specific financial institutions, typically consisting of 8 to 11 characters. Its structure is as follows:

- Bank Code (4 characters) : The first four characters represent the financial institution's name. For example, the Central Bank of Paraguay's code is BCPA.

- Country Code (2 characters) : The next two letters indicate the country where the bank is located. Paraguay's code is PY.

- Location Code (2 characters) : The following two characters specify the bank's geographic location within the country.

- Branch Code (3 characters) : The final three characters denote a specific branch. If the transfer is directed to the bank's headquarters, "XXX" is typically used.

Thus, the complete SWIFT/BIC code for the Central Bank of Paraguay is BCPAPYPXGON, where BCPA is the bank code, PY is the country code, PX is the location code, and GON represents the branch code.

The Importance of Accurate SWIFT/BIC Codes

Accuracy in SWIFT/BIC codes is critical for international transfers. Even minor errors can lead to delays, lost funds, or irreversible financial risks. Key considerations include:

- Verifying the bank name matches the recipient's financial institution.

- Confirming the branch name if the transfer involves a specific branch.

- Ensuring the country code aligns with the destination country.

- Double-checking the transfer amount before submission.

Sending Money to the Central Bank of Paraguay: Key Considerations

When transferring funds to the Central Bank of Paraguay using SWIFT/BIC codes, keep the following in mind:

- Always use the correct SWIFT/BIC code to ensure the funds reach the intended account.

- Communicate with the recipient in advance to obtain accurate account details, including the account holder's name, account number, and the bank's full address.

- Carefully review all information before submission to avoid errors that could cause delays or failed transactions.

- Be aware that processing times for international transfers vary between financial institutions.

Why Choose Xe for International Money Transfers?

Selecting a reliable platform for international transfers can enhance efficiency and security. Xe, a leading provider in this space, offers several advantages:

- Competitive Exchange Rates : Xe typically provides more favorable exchange rates than traditional banks, helping users save on transfer costs.

- Transparent Fee Structure : All fees are clearly displayed before confirming a transfer, eliminating unexpected charges.

- Fast Transactions : Most transfers are completed on the same day, ensuring timely delivery of funds.

- User-Friendly Interface : The platform's intuitive design makes international transfers accessible even for first-time users.

- 24/7 Customer Support : Xe offers round-the-clock assistance to address any questions or concerns.

Step-by-Step Guide to Using Xe for International Transfers

To send money via Xe, follow these simple steps:

- Create an Account : Register on Xe's website with your basic details.

- Select the Transfer Amount : Enter the amount you wish to send, and the system will display the applicable exchange rate and fees.

- Enter Recipient Details : Provide the recipient's name, address, and the bank's SWIFT/BIC code.

- Confirm the Information : Review all details before submitting the transfer.

- Track the Transfer : Monitor the transaction's progress through your Xe account until the funds are delivered.

Conclusion

International money transfers are a vital component of global finance, and SWIFT/BIC codes play a fundamental role in ensuring secure transactions. Understanding their structure and proper usage can safeguard your funds and streamline the transfer process. Platforms like Xe further enhance efficiency by offering competitive rates, transparency, and user-friendly features. Always verify details before initiating a transfer to ensure a smooth and successful transaction.