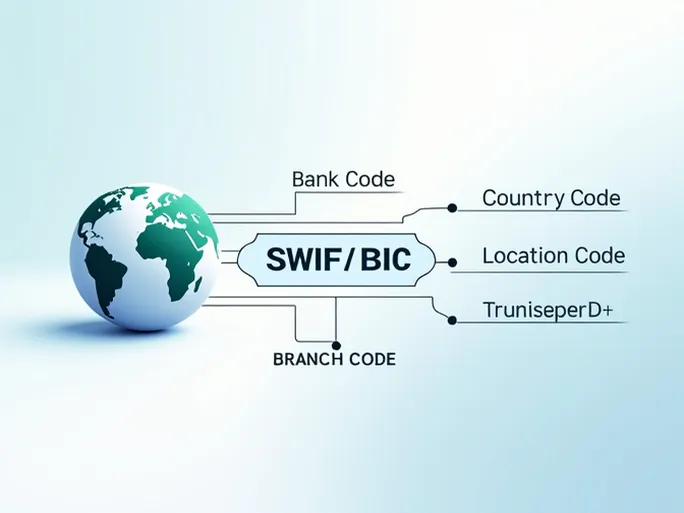

International wire transfers often encounter delays due to incorrect banking codes, primarily stemming from misunderstandings about SWIFT/BIC identifiers. These unique 8-11 character alphanumeric codes serve as critical markers in the global financial network, pinpointing specific banks and their branches worldwide.

Decoding the SWIFT/BIC Structure

Take BANCO CENTRAL DEL PARAGUAY (Central Bank of Paraguay) as an example. Its SWIFT/BIC code BCPAPYPXXXX breaks down into meaningful segments:

BCPA - Bank code (identifies Banco Central del Paraguay)

PY - Country code (Paraguay)

PX - Location code (headquarters designation)

XXX - Branch identifier ("XXX" denotes the main office)

This structure reveals comprehensive information about the financial institution. The 8-character version BCPAPYPX represents the essential identifier, while the full 11-character code BCPAPYPXXXX specifies the main branch located at AVENIDA FEDERACION RUSA ESQUINA in ASUNCION.

Why Accuracy Matters

Precise SWIFT/BIC code usage prevents transaction errors that could freeze funds in transit for weeks. Verification through official banking channels remains essential before initiating transfers, as even minor discrepancies can redirect payments or trigger compliance reviews.

Financial institutions globally maintain standardized code directories, with the Society for Worldwide Interbank Financial Telecommunication (SWIFT) serving as the primary governance body. The system's structured approach enables automated routing across 200+ countries while maintaining security protocols.