In today's globalized financial landscape, international money transfers have become indispensable. At the heart of this process lies the SWIFT/BIC code—a crucial tool that goes beyond merely identifying banks to ensuring secure and timely delivery of funds across borders.

Take LIETUVOS BANKAS (Bank of Lithuania), for example. Its SWIFT/BIC code LIABLT2XSNO consists of four distinct components: the bank code (LIAB), country code (LT), location code (2X), and branch identifier (SNO). Notably, codes ending with "XXX" typically represent a bank's headquarters—a detail that reflects the institution's global operational footprint.

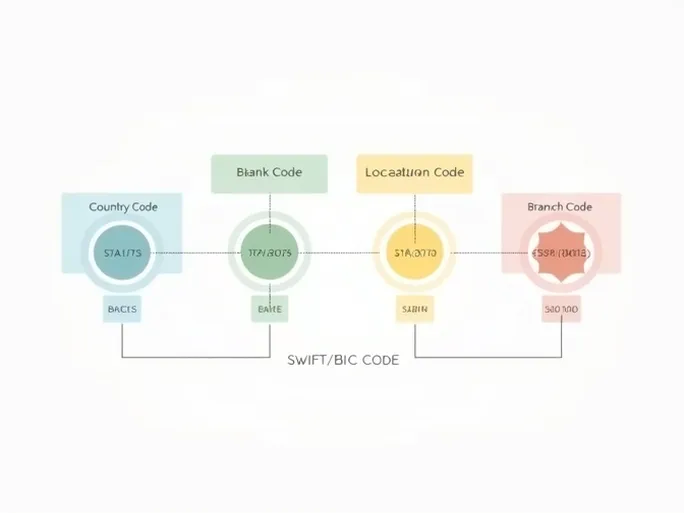

Decoding the SWIFT/BIC Structure

These 8-11 character alphanumeric codes serve as universal identifiers for financial institutions worldwide. Each segment plays a vital role:

- Bank Code (LIAB): Uniquely identifies LIETUVOS BANKAS

- Country Code (LT): Denotes the bank's registration in Lithuania

- Location Code (2X): Pinpoints the institution's headquarters

- Branch Code (SNO): Specifies particular banking divisions

Verifying each component remains essential for seamless international transactions. Even minor discrepancies can lead to processing delays or failed transfers.

Enhancing Transfer Efficiency

For those conducting transactions with LIETUVOS BANKAS, specialized platforms offer significant advantages over traditional banking channels. These services typically provide:

- More competitive exchange rates

- Full fee transparency before transaction confirmation

- Same-day processing for most transfers

Such features enable users to optimize fund allocation while accelerating capital movement—critical factors in time-sensitive financial operations.

Global Transaction Support

Recognizing the complexities of international banking, leading platforms now offer round-the-clock professional assistance to address SWIFT-related inquiries and transaction challenges.

"The service proved exceptionally efficient and user-friendly," remarked one satisfied client. Another noted, "The professionalism and expertise of support staff, particularly native-language representatives, significantly enhanced my confidence in the process."

By combining accurate SWIFT code information with efficient transfer platforms, individuals and businesses can achieve streamlined international payment experiences that meet modern financial demands.