In today's increasingly interconnected global economy, the security, efficiency, and accuracy of financial transactions have become paramount. Whether conducting international trade, investments, or personal cross-border transfers, the importance of SWIFT/BIC codes cannot be overstated.

The SWIFT (Society for Worldwide Interbank Financial Telecommunication) system provides financial institutions with a global communication platform. Through its BIC (Bank Identifier Code), it enables secure information exchange and efficient processing of international transfers between banks.

Understanding ABANCA's SWIFT Code

ABANCA CORPORACION BANCARIA, S.A., a leading Spanish bank, operates with the SWIFT code CAGLESMM COP . This unique identifier ensures accurate recognition of the bank and its associated account information during international transfers.

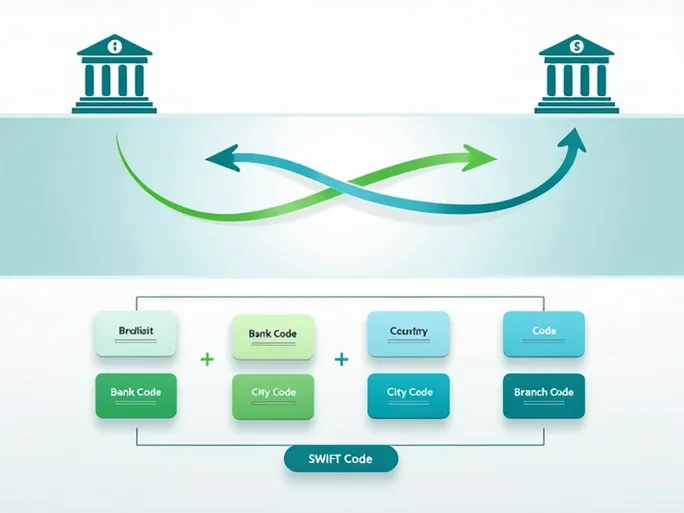

A typical SWIFT code consists of 8 to 11 characters with specific meanings:

- First 4 characters: Bank code (CAGL for ABANCA)

- Next 2 characters: Country code (ES for Spain)

- Following 2 characters: Location code (MM for Madrid)

- Last 3 characters (optional): Branch code (COP for specific branch)

ABANCA's headquarters are located at BACK.OFFICE COMEX, RUA NUEVA 30-1, PLANTA 74, ABANCA, LA CORUNA, A CORUNA, 15003, Spain. When initiating transfers, users should verify not only the SWIFT code but also understand the bank's operational procedures, applicable fees, and estimated processing times.

Currency Conversion and Transfer Considerations

For international transfers involving currency conversion, such as sending $10,000 to ABANCA, understanding exchange rates becomes crucial. Market fluctuations and bank fees significantly impact the final amount received. For example, under current market conditions, a $10,000 transfer might yield approximately €8,490 after conversion and fees.

Ensuring Secure and Efficient Transfers

The accuracy of SWIFT codes directly impacts transaction outcomes. Incorrect codes may cause delays, losses, or misdirected funds, potentially creating significant problems for individuals and businesses alike. Users are strongly advised to double-check all banking details before initiating transfers.

In the digital finance era, the security and convenience of cross-border transactions affect both personal fund movements and corporate financial stability. Careful consideration is required when selecting banks, verifying SWIFT codes, calculating transfer costs, and choosing intermediary services.

The case of ABANCA's SWIFT code CAGLESMM COP illustrates the global financial system's reliance on standardized identifiers. As financial technology continues to evolve, understanding these processes and selecting appropriate transfer methods provides additional security for international transactions.