In today's global financial markets, where transactions occur with remarkable frequency, ensuring the secure and accurate transfer of funds to designated accounts has become paramount. When conducting international transfers—particularly to major financial institutions such as UBS Switzerland AG—using the correct SWIFT code is essential. An accurate SWIFT code not only helps prevent delays and failures in transactions but also enhances security and convenience for customers.

Decoding the UBS Switzerland SWIFT Code

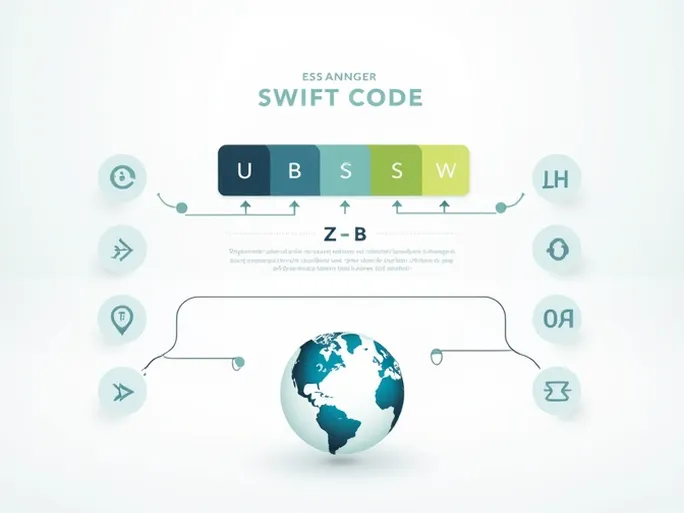

UBS Switzerland AG, one of the world's most prominent banks, operates with the SWIFT code UBSWCHZH12B . This alphanumeric sequence is far more than a formality; it contains critical information that facilitates the smooth movement of funds across borders. Let's break down its structure:

The first four letters ( UBSW ) represent the bank code, uniquely identifying UBS Switzerland AG. This ensures funds are directed to the correct financial institution. The following two letters ( CH ) constitute the country code for Switzerland, confirming the destination within the Swiss financial system.

The next two characters ( ZH ) indicate the location code, specifying the bank's headquarters. This detail is particularly important for tracing the precise path of international transfers. The final characters ( 12B ) provide the branch code, which is crucial for transaction accuracy. Typically comprising 8 to 11 characters, SWIFT codes were designed to deliver efficient information transmission and precise navigation for cross-border payments.

The SWIFT System: Connecting Global Finance

The SWIFT network (Society for Worldwide Interbank Financial Telecommunication) serves as the backbone of international monetary transactions, linking banks and financial institutions worldwide. The precision of this system directly impacts transaction success rates. Even minor errors can lead to failed transfers, frozen funds, or significant financial losses. Therefore, customers must verify the SWIFT/BIC code before initiating any international transfer to minimize risks.

Banks may occasionally update their names or SWIFT codes, making it essential for customers to stay informed. Official bank websites and customer service hotlines provide reliable sources for verification. Many banks also display current SWIFT codes within their mobile apps or online banking platforms, offering users immediate access to international transfer guidelines.

Minimizing Risks in International Transfers

For large-value transactions or frequent cross-border payments, understanding the recipient bank's SWIFT code and related terms is crucial. Errors in code entry can cause transfer failures or delays, creating unnecessary complications. Financial institutions are increasingly enhancing digital services to help customers quickly and accurately retrieve SWIFT information during transactions.

Beyond facilitating fund transfers, SWIFT codes play a vital role in global financial operations. These codes serve as foundational data points that enable banks to execute complex transactions securely and efficiently. For individuals and businesses engaged in regular international transactions, comprehending SWIFT code structure and significance is an indispensable aspect of financial management.

Building Financial Literacy for Secure Transactions

Maintaining regular communication with financial institutions and expanding knowledge about transfer protocols can significantly benefit customers. Some misconceptions persist—for instance, the belief that simply entering a bank's name ensures successful fund delivery. In practice, accurate SWIFT codes are non-negotiable for preventing misdirected payments and safeguarding assets.

As technology advances, customers should adapt to new financial tools and services. Educational resources such as courses, webinars, or professional consultations can enhance financial literacy. Developing sound financial habits establishes long-term security for international transactions.

Regardless of transfer amounts, SWIFT code accuracy remains fundamental to successful fund movements. Attention to these details ensures correct banking information, substantially reducing risks of financial loss due to coding errors. This vigilance not only protects personal finances but also fosters trust in international markets. In an era of increasing cross-border payments, mastering this fundamental financial knowledge proves invaluable for all parties involved.