In modern international financial transactions, the correct use of SWIFT/BIC codes is crucial for ensuring timely and seamless fund transfers. But do you truly understand these codes and how to use them properly? This article examines the structure of MEGA International Commercial Bank's SWIFT/BIC code to help prevent potential issues and delays in wire transfers.

Decoding the SWIFT/BIC Structure

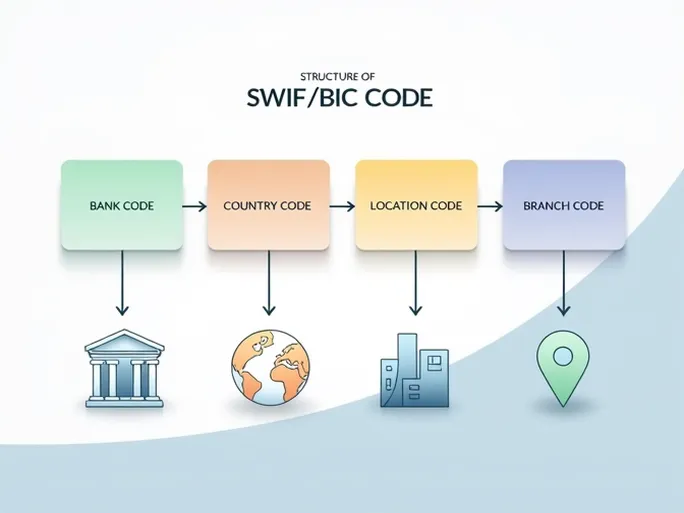

A SWIFT/BIC code is an 8-11 character alphanumeric identifier that uniquely identifies banks and their branches worldwide. For MEGA International Commercial Bank (MEGA INTERNATIONAL COMMERCIAL BANK CO., LTD.), the code breaks down into distinct components:

- Bank Code (ICBC): The first four characters identify the specific financial institution.

- Country Code (TW): The next two letters indicate Taiwan as the bank's registered location.

- Location Code (TP): These two characters specify the bank's headquarters city.

- Branch Code (006): The final three digits (optional) pinpoint a specific branch. Codes ending with "XXX" typically represent a bank's head office.

Essential Verification Steps

Using incorrect SWIFT codes can cause significant transfer delays or even loss of funds. Before initiating international payments, verify these critical details:

- Bank Name Accuracy: Confirm the recipient bank's official name matches exactly with the information provided.

- Branch Specifics: When using branch-specific codes, ensure alignment between the code and the recipient's actual branch location.

- Country Consistency: Verify the SWIFT code's country designation corresponds to the destination bank's physical location to prevent misrouting.

Proper understanding and application of SWIFT/BIC codes enables more confident participation in global financial markets while safeguarding the security and efficiency of cross-border fund transfers.