In today's interconnected world, where globalization and economic integration continue to accelerate, international money transfers have become an indispensable part of financial management for both individuals and businesses. With the increasing frequency of cross-border transactions amid rapidly changing economic conditions, concerns about fund security, convenience, and transaction fees have grown significantly. At the heart of these complex international financial transactions lies the crucial role played by bank SWIFT/BIC codes. Using MEGA Commercial Bank as an example, we examine the bank's background, the significance of its SWIFT/BIC code, and how to ensure secure and efficient international money transfers.

MEGA Commercial Bank: A Global Financial Institution

Founded in 1962 and headquartered in Taichung, Taiwan, MEGA Commercial Bank has established itself as a provider of diversified financial services. The bank enjoys a strong reputation not only in its domestic market but also maintains an extensive global network, particularly in Southeast Asia and North America. Through continuous technological innovation, MEGA Commercial Bank has developed a range of financial products and services designed to meet the diverse needs of clients in an increasingly globalized economy.

The bank's SWIFT/BIC code, ICBCTWTP , may appear as a simple combination of letters and numbers, but it contains vital information. Each country's financial institutions have their own unique SWIFT/BIC codes, and correct usage of these codes during international transactions significantly enhances both the security and efficiency of fund transfers. For anyone conducting international transactions, understanding how to properly use MEGA Commercial Bank's SWIFT/BIC code proves essential.

Understanding SWIFT/BIC Code Structure and Function

SWIFT codes, also known as Bank Identifier Codes (BIC), typically consist of 8 to 11 characters, with each segment conveying specific information. The structure breaks down as follows:

- Bank Code (ICBC) : Identifies MEGA Commercial Bank

- Country Code (TW) : Indicates Taiwan as the country of origin

- Location Code (TP) : Specifies the bank's physical location

- Branch Code (004) : Identifies a specific branch (XXX typically represents the head office)

Understanding this structure provides confidence when initiating international transfers, as accuracy in these details forms the foundation for successful transactions.

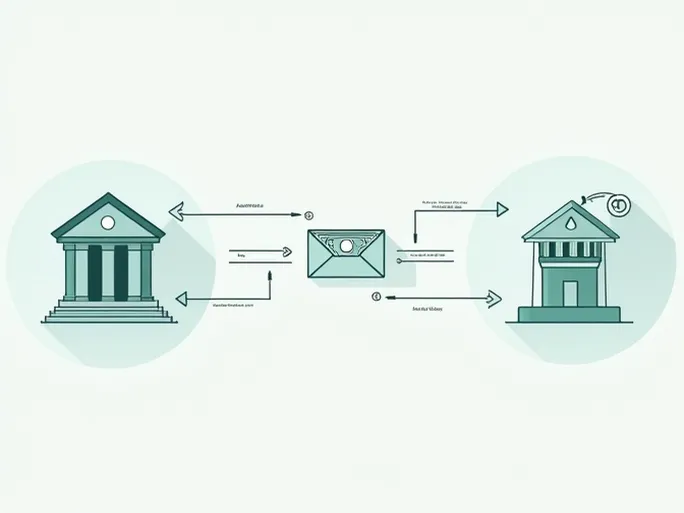

Application in International Money Transfers

For many individuals, particularly those initiating international transfers for the first time, the process may seem daunting. Using MEGA Commercial Bank's SWIFT code as reference, here are the standard steps involved:

- Collect recipient information : Obtain complete banking details including bank name, SWIFT/BIC code, account number, and the recipient's full name and address.

- Complete transfer application : Access online banking services or visit a branch to fill out the international transfer form, paying particular attention to the SWIFT/BIC code accuracy.

- Verify transaction details : Carefully review all information before submission to prevent errors that could delay or misdirect funds.

- Pay applicable fees : Confirm and pay any transfer fees according to the bank's policies.

- Submit the application : After confirmation, submit the request, which typically processes within 1-5 business days.

- Monitor transfer status : Retain transaction records and utilize tracking services to confirm successful delivery of funds.

Advantages of Using SWIFT Codes

As international commerce continues to expand, SWIFT codes demonstrate increasing importance with several notable benefits:

- Accuracy : Ensures funds reach precisely the intended destination

- Security : Provides safer transactions compared to informal channels

- Transparency : Enables clear tracking throughout the transfer process

- Global reach : Connects nearly all internationally active financial institutions

Ensuring Secure and Efficient Transfers

To maximize security and efficiency during international transfers, consider these additional measures:

- Confirm the current validity of SWIFT/BIC codes, as they may change due to bank mergers or reorganizations

- Maintain communication with recipient banks to quickly resolve potential issues

- Utilize only authorized banking channels for transactions

- Take advantage of tracking services to monitor transfer progress

Conclusion

As international trade continues to expand, proficiency with SWIFT/BIC codes like MEGA Commercial Bank's ICBCTWTP004 becomes increasingly vital for secure and efficient cross-border transactions. This knowledge not only enhances confidence in global financial activities but also provides essential protection for economic operations.

The ongoing evolution of financial technology promises to further streamline international payment services while strengthening security measures. In this dynamic environment, continuous learning and adaptation remain crucial for all participants in the global financial landscape.