In today's globalized financial landscape, ensuring the security and efficiency of fund transfers is paramount. Whether conducting cross-border transactions or sending international remittances, the correct use of SWIFT/BIC codes significantly enhances the speed and reliability of money transfers. But how exactly do these codes work, and why are they critical?

Take BANCA MONTE DEI PASCHI DI SIENA S.P.A., one of Italy's oldest financial institutions, as an example. Its SWIFT code, PASCITMMALB , is not merely a random string of characters but a vital communication bridge connecting senders to this established banking entity.

The Significance of SWIFT/BIC Codes

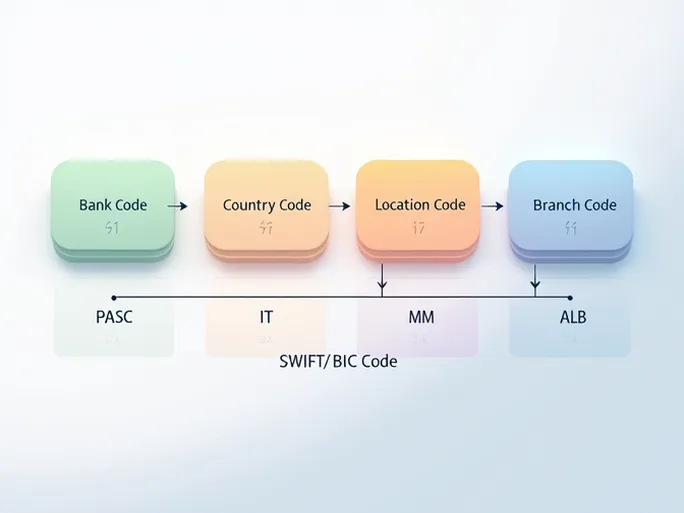

SWIFT/BIC codes typically consist of 8 to 11 alphanumeric characters, each segment serving a specific purpose to facilitate secure transactions. For BANCA MONTE DEI PASCHI DI SIENA S.P.A., the structure of PASCITMMALB reveals key details:

- Bank Code (PASC) : Identifies the financial institution uniquely.

- Country Code (IT) : Specifies Italy as the destination country.

- Location Code (MM) : Indicates the bank's headquarters city.

- Branch Code (ALB) : Pinpoints the exact branch for precise fund routing.

For international wire transfers to BANCA MONTE DEI PASCHI DI SIENA S.P.A.'s branch in Albinia, Orbetello (GR, 58015), using the correct SWIFT code PASCITMMALB is essential. This minimizes risks of delays or misdirected payments, ensuring a seamless transaction process.

Conclusion

In cross-border financial operations, accuracy in SWIFT/BIC code usage directly impacts transaction success rates and fund security. By leveraging codes like PASCITMMALB , individuals and businesses can engage in efficient, secure global transactions with confidence.