Navigating the complexities of international money transfers requires familiarity with technical terminology, among which the SWIFT code stands as a fundamental yet critical component. Mastering this element ensures smooth and secure cross-border transactions.

This article explores the structure and application of SWIFT codes, along with insights into optimizing international transfers. Using UBS EUROPE SE, LUXEMBOURG BRANCH as an example, we examine how SWIFT codes facilitate secure and efficient fund transfers.

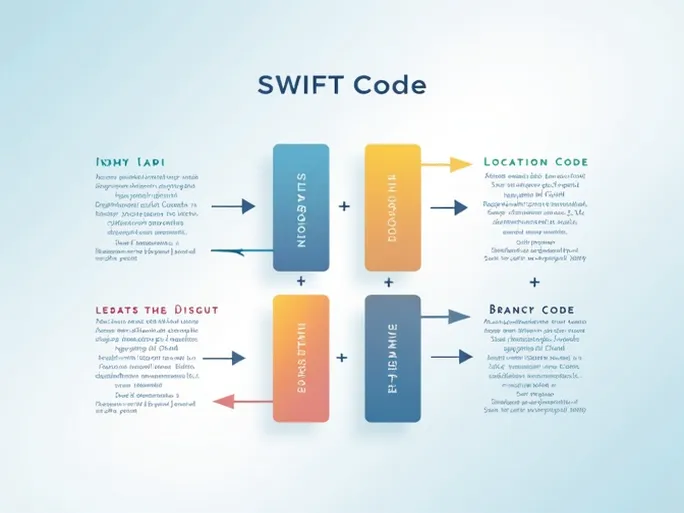

1. The Anatomy of a SWIFT Code

A SWIFT code, also known as a Bank Identifier Code (BIC), is an 8- to 11-character alphanumeric sequence that uniquely identifies banks and financial institutions worldwide. Understanding its structure is essential. Consider the SWIFT code UBSWLULLFSL for UBS EUROPE SE, LUXEMBOURG BRANCH:

- Bank Code (First 4 characters): UBSW (identifies UBS EUROPE SE)

- Country Code (Next 2 characters): LU (denotes Luxembourg)

- Location Code (Next 2 characters): LL (specifies the bank's location within the country)

- Branch Code (Last 3 characters): FSL (identifies the specific branch)

Each segment conveys specific information. The bank code identifies the institution, the country code specifies the nation, the location code pinpoints the bank's geographic area, and the branch code distinguishes individual branches. Codes ending with 'XXX' typically represent a bank's headquarters rather than a specific branch.

2. The Critical Role of SWIFT Codes in International Transfers

SWIFT codes serve as the backbone of secure international transactions, acting as a bank's unique identifier and minimizing errors during fund transfers.

2.1 Ensuring SWIFT Code Accuracy

Always verify the SWIFT code before initiating a transfer. Cross-check the code via the bank's official website or customer service to avoid errors that could delay or misdirect funds.

2.2 Verifying Recipient Bank Details

Double-check all recipient information, including the name, bank, and account number. For example, when using the SWIFT code UBSWLULLFSL , confirm the recipient's bank is indeed UBS EUROPE SE, LUXEMBOURG BRANCH to prevent transfer failures.

2.3 How the SWIFT Network Operates

The SWIFT network enables secure electronic communication between banks, facilitating rapid transfers—often within hours—especially for large transactions. Familiarity with this system helps optimize transfer timing.

3. Preparing for an International Transfer

Thorough preparation ensures timely and secure transactions. Key steps include:

3.1 Gathering Required Documents

Essential details for international transfers include:

- Recipient's full name

- Recipient's bank name and SWIFT code

- Recipient's account number

- Transfer amount and currency

3.2 Selecting the Right Transfer Method

Beyond traditional bank transfers, consider digital platforms that offer competitive exchange rates and faster processing times.

4. Enhancing Transfers with Specialized Services

Certain platforms specialize in international transfers, providing advantages such as:

4.1 Competitive Exchange Rates and Fees

Transparent fee structures help avoid unexpected costs, making transfers more economical.

4.2 Expedited Processing

Many services complete transfers within hours, a significant advantage for urgent transactions.

4.3 User-Friendly Interfaces

Intuitive platforms simplify the transfer process for both novice and experienced users.

4.4 Dedicated Support

Responsive customer service ensures assistance with any issues, from technical glitches to exchange rate inquiries.

5. Leveraging Knowledge for Seamless Transfers

International transfers need not be daunting. By verifying SWIFT codes, preparing meticulously, and leveraging specialized services, individuals can execute transactions with confidence. Sharing experiences and insights further enhances collective understanding, ensuring funds move securely and efficiently across borders.

In summary, SWIFT codes are indispensable for international banking. Confirming their accuracy and pairing them with reliable transfer methods safeguards funds and streamlines the process. This guide aims to empower readers with the knowledge needed to navigate global transactions effectively.