In today's global economy, cross-border remittances have become commonplace for both individuals and businesses. Whether for international trade payments, foreign investments, family support, or various commercial needs, understanding and correctly using SWIFT codes is crucial. SWIFT (Society for Worldwide Interbank Financial Telecommunication) facilitates interbank transfers worldwide, with each bank's SWIFT code serving as its unique identifier in this network.

Structure and Significance of SWIFT/BIC Codes

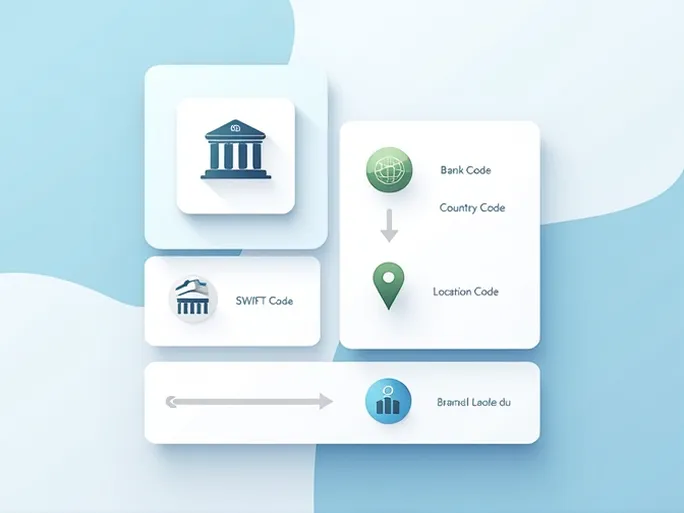

ICICI Bank's SWIFT code is "ICICINBB006." This alphanumeric sequence follows a standardized structure:

- First four letters (ICIC): Bank identifier for ICICI BANK LIMITED

- Next two letters (IN): Country code for India

- Following two letters (BB): Location code indicating Kolkata

- Final three digits (006): Optional branch identifier

This systematic format enables senders to precisely identify recipient banks, significantly enhancing international transfer efficiency.

ICICI Bank Overview

Established in 1994, ICICI Bank ranks among India's largest private financial institutions, offering comprehensive services including retail banking, corporate banking, and investment banking. Headquartered at Rasoi Court, 20 R.N. Mukherjee Road in Kolkata, the bank maintains robust international operations with stringent security protocols to safeguard client assets.

When SWIFT/BIC Codes Are Required

International remittances invariably require SWIFT codes. For instance, transferring funds from the United States to an ICICI Bank account in India necessitates providing "ICICINBB006" in the transaction details. Common use cases include:

- Personal remittances: Family support or peer-to-peer transfers

- Commercial payments: Settlements with international suppliers or clients

- Cross-border investments: Capital allocation in foreign markets

Proper Usage Guidelines

Accuracy is paramount when utilizing SWIFT codes. Key considerations include:

- Verifying the SWIFT code with recipients or official bank sources

- Accounting for time zone differences in processing periods

- Understanding applicable transaction fees

- Retaining payment confirmations for reference

SWIFT Codes' Role in Global Finance

Beyond simple identification, SWIFT codes serve critical functions in international banking:

- Enhancing transaction security through standardized verification

- Expediting processing times via uniform communication protocols

- Facilitating worldwide financial connectivity across 200+ countries

ICICI's International Operations

With extensive global reach across North America, Europe, and Asia-Pacific, ICICI Bank provides multinational clients with diverse transfer options including digital platforms, telephone banking, and in-person services. The institution tailors solutions for both individual and corporate banking needs.

Key Precautions

When initiating international transfers, clients should:

- Double-check all recipient details

- Monitor transaction status until completion

- Maintain records of all correspondence

- Consult bank representatives for first-time transactions

Mastering ICICI Bank's SWIFT code system enables efficient, secure international fund movement for various financial purposes. The standardized identification mechanism remains fundamental to global banking operations, ensuring reliable cross-border transactions.