In today's interconnected global economy, the security and efficiency of international financial transactions have become paramount. Among the critical elements facilitating cross-border bank transfers, SWIFT/BIC codes play a vital role in ensuring smooth fund movements. This report provides a comprehensive analysis of LIETUVOS BANKAS (Bank of Lithuania) SWIFT/BIC code—LIABLT2XDCA—and explores how digital platforms can enhance international money transfer experiences.

Understanding SWIFT/BIC Codes

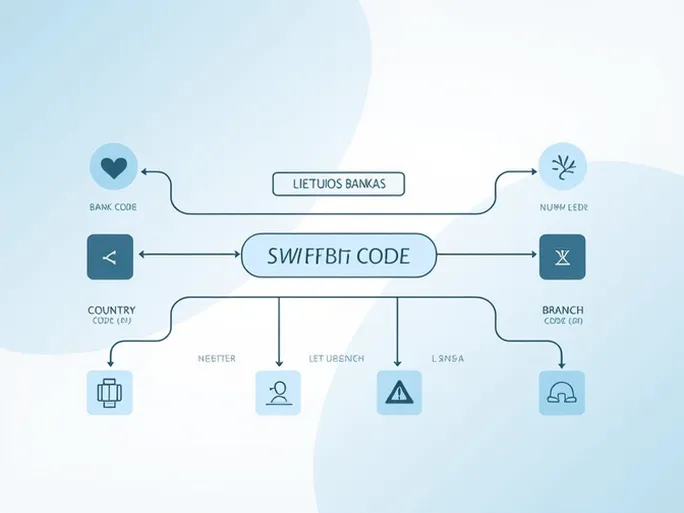

SWIFT/BIC codes are unique identifiers consisting of 8 to 11 alphanumeric characters that specify particular banks and their branches worldwide. This standardized system, maintained by the Society for Worldwide Interbank Financial Telecommunication (SWIFT), guarantees secure and efficient global financial transactions.

Decoding LIETUVOS BANKAS's SWIFT/BIC: LIABLT2XDCA

The SWIFT/BIC code LIABLT2XDCA for LIETUVOS BANKAS breaks down into these components:

- Bank Code (LIAB): Identifies LIETUVOS BANKAS as the financial institution

- Country Code (LT): Denotes Lithuania as the bank's location

- Location Code (2X): Specifies the bank's headquarters

- Branch Code (DCA): Indicates a specific branch, with "XXX" typically representing the head office

This structured coding system enables international payments to reach the intended bank and branch accurately and promptly.

The Critical Importance of Accurate SWIFT Codes

When initiating international wire transfers, providing the correct SWIFT code is essential to ensure funds reach their intended destination. To avoid transaction delays or financial complications, consider these verification steps:

- Confirm the recipient bank's name matches the SWIFT code

- Verify the branch-specific code corresponds with the recipient's banking details

- Double-check the country code aligns with the recipient bank's location

Optimizing International Transfers

When conducting transactions with LIETUVOS BANKAS, digital money transfer platforms offer distinct advantages over traditional banking channels:

- Competitive Exchange Rates: Often more favorable than standard bank offerings

- Transparent Fee Structures: Clear disclosure of all charges before transaction completion

- Expedited Processing: Many transfers are completed within the same business day

Global Support Availability

Leading digital transfer services provide round-the-clock customer support, ensuring assistance is available whenever needed for international transactions.

User Experiences

Digital money transfer services have garnered positive feedback from users worldwide, with comments highlighting:

"Exceptionally fast and convenient service."

"Outstanding service quality and reliability."

"Helpful and professional customer support."

Disclaimer

The information provided regarding SWIFT codes and banking details serves for reference purposes only. While every effort has been made to ensure accuracy, the completeness and currentness of the information cannot be guaranteed. Individuals should verify all financial details with relevant institutions before initiating transactions.

In summary, the SWIFT/BIC code for LIETUVOS BANKAS represents a crucial component in the secure and efficient movement of funds across borders. By leveraging modern financial platforms, individuals and businesses can benefit from optimized exchange rates, reduced fees, and accelerated transfer times when conducting international transactions.