In the complex process of international money transfers, the SWIFT/BIC code plays a crucial role. For instance, did you know that ASB Bank's SWIFT code is ASBBNZ2AMMD ? This alphanumeric sequence represents a critical component for successful cross-border fund transfers. This article provides a detailed breakdown of ASB BANK LIMITED's SWIFT code to help you navigate international payments with confidence.

Understanding the structure of SWIFT codes is fundamental. The code ASBBNZ2AMMD contains vital information about the recipient bank. The first four letters "ASBB" identify ASB BANK LIMITED, followed by "NZ" which denotes the bank's country (New Zealand). The subsequent "2A" specifies the institution and its location, while "MMD" identifies a particular branch using alphabetical characters.

Accuracy in information transmission is paramount during international transfers. Consider this example: when sending $10,000.00 to France, the recipient ultimately receives €8,490.00. This transaction demonstrates how proper SWIFT code usage must be accompanied by awareness of exchange rates and processing fees, both of which significantly impact the final received amount.

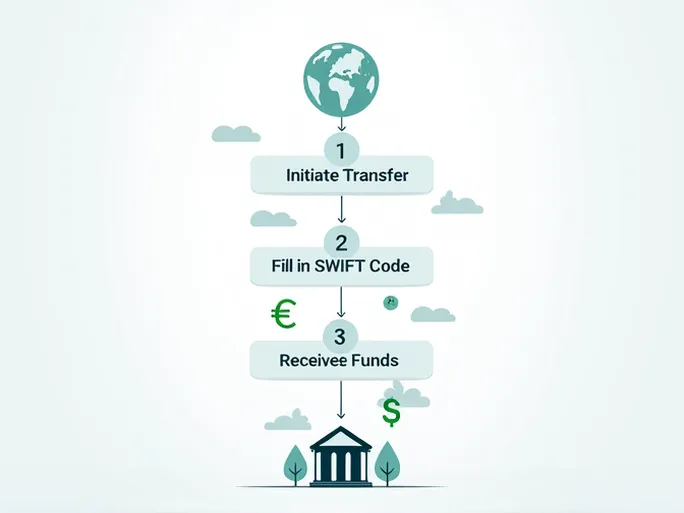

Familiarity with ASB Bank's SWIFT code serves multiple purposes: it minimizes errors, enhances transaction security, and improves processing efficiency. Prior to initiating any transfer, verifying the SWIFT code against the recipient bank's details remains an essential step to ensure funds reach their intended destination promptly and accurately.

Mastering SWIFT code usage empowers individuals and businesses to conduct international transactions with greater efficiency. For future cross-border payments, thorough understanding of SWIFT codes and related transfer details will optimize financial operations and streamline global money movement.