In the era of digital finance, accurate international banking details are critical. For individuals or businesses sending funds to Denmark, the SWIFT code SPNODK22123 for SPAR NORD BANK A/S serves as a vital piece of information. Yet, this code is more than a random sequence—it ensures secure cross-border transactions by uniquely identifying the bank and its branch.

Decoding the SWIFT/BIC Structure

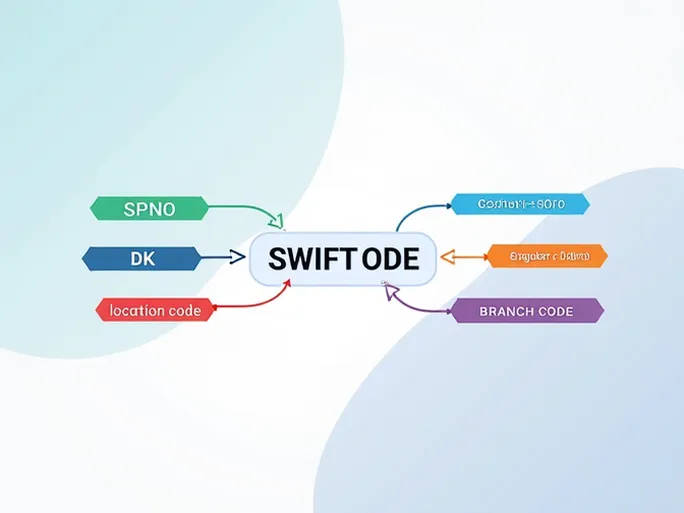

A SWIFT/BIC code, typically 8–11 characters long, globally identifies a specific bank and its branch. The components of SPNODK22123 break down as follows:

- Bank Code (SPNO) : The first four letters represent SPAR NORD BANK A/S, the financial institution’s identifier.

- Country Code (DK) : The following two letters, "DK," confirm the bank’s location in Denmark, clarifying the transaction’s destination.

- Location Code (22) : The next two digits pinpoint the bank’s headquarters or primary region, which may influence processing times for location-sensitive transfers.

- Branch Code (123) : The final three digits specify a particular branch, ensuring funds reach the correct destination within the bank’s network.

Ensuring Accurate Transfers

Mistakes in SWIFT codes can lead to delayed, failed, or lost transactions. Before initiating a transfer, verify the code with the recipient and cross-check the bank’s physical address. While SPNODK22123 is SPAR NORD BANK A/S’s standard code, some branches may use variations. Direct confirmation with the bank is strongly advised to prevent errors.

Why Precision Matters

Understanding SWIFT/BIC codes safeguards international payments, enhancing efficiency and security in global finance. Whether for personal remittances or corporate transactions, meticulous attention to these details ensures seamless fund movement. By adhering to these guidelines, senders can minimize risks and guarantee successful cross-border transfers.