In today's globalized economy, international money transfers have become a vital component of daily transactions for individuals, businesses, and institutions. Ensuring that funds reach their destination securely and efficiently is a top priority for every sender. One critical tool in this process is the SWIFT/BIC code, which plays a pivotal role in cross-border payments. For Italy's renowned UniCredit S.P.A., the SWIFT/BIC code UNCRITMMCEE serves as a key identifier, with its primary office located at Piazza Gae Aulenti 4, Milan, ZIP code 20154.

What Is a SWIFT/BIC Code?

A SWIFT/BIC code is a standardized identifier used to recognize financial institutions worldwide, facilitating the swift and accurate transfer of funds across borders. Typically consisting of 8 to 11 characters, the code is structured to include:

- Bank Code: A 4-letter sequence representing the specific financial institution.

- Country Code: A 2-letter identifier based on the ISO 3166-1 standard, indicating the bank's country.

- Location Code: A 2-character combination (letters or digits) specifying the bank's exact location.

- Branch Code (Optional): A 3-digit or letter sequence designating a particular branch.

This structured format enhances transparency and efficiency in international fund transfers.

UniCredit S.P.A. and Its SWIFT/BIC Code

As one of Europe's largest banking groups, UniCredit S.P.A. holds a significant position in international finance. With an extensive network spanning multiple countries, the bank offers comprehensive services, including personal and corporate banking, as well as asset management. Its SWIFT/BIC code, UNCRITMMCEE , is widely used by businesses and individuals for seamless cross-border transactions.

Advantages of Using UniCredit S.P.A.'s SWIFT/BIC Code

Utilizing UniCredit S.P.A.'s SWIFT/BIC code for international transfers offers several key benefits:

- Global Recognition: The code is universally accepted, fostering economic connectivity across nations.

- Security and Accuracy: Standardized codes reduce the risk of errors or misdirected payments.

- Efficiency: Ensures timely processing, minimizing delays in fund transfers.

How to Use a SWIFT/BIC Code for International Transfers

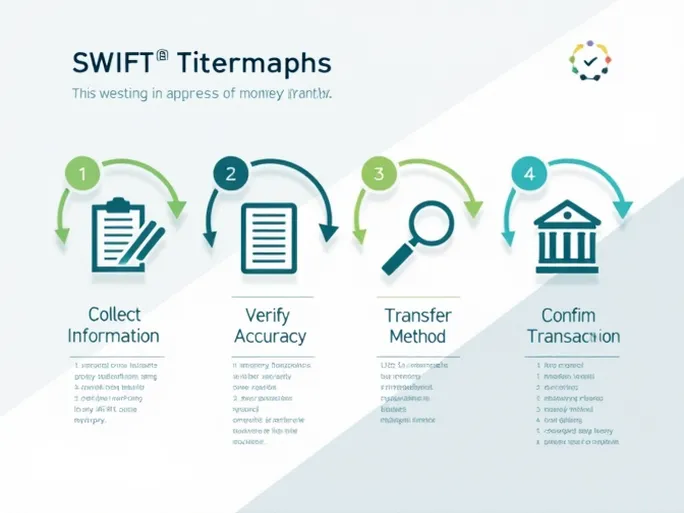

To ensure a smooth and secure transaction, follow these steps:

- Gather Required Information: Obtain the recipient's bank details, including the SWIFT/BIC code, account name, and account number.

- Verify Accuracy: Double-check all entered details to prevent errors that could delay the transfer.

- Select a Transfer Method: Choose between bank counters, online banking, or other authorized channels.

- Confirm the Transaction: Retain the transaction reference number for tracking purposes.

Enhancing Security in International Transfers

While SWIFT/BIC codes provide a secure framework, additional precautions can further safeguard transactions:

- Reputable Banks: Work only with trusted financial institutions known for transparency and reliability.

- Vigilance Against Fraud: Be cautious of phishing attempts and verify all communications through official channels.

- Two-Factor Authentication: Enable additional security measures for online transactions where available.

Conclusion

The SWIFT/BIC code UNCRITMMCEE is a critical tool for secure and efficient international transactions with UniCredit S.P.A. Whether for personal or business purposes, accurate use of this code ensures seamless cross-border payments. As global economic integration continues to deepen, mastering these financial instruments enhances efficiency and unlocks new opportunities in international commerce.