When sending money to an international bank, have you ever considered how a small combination of letters could significantly impact the flow of your funds? The SWIFT/BIC code, a global standard for bank identification, ensures your transaction is processed quickly and accurately. For instance, the SWIFT/BIC code for UNICREDIT S.P.A. is UNCRITMMCEE . While this code may appear complex, it contains essential information about the bank and its location.

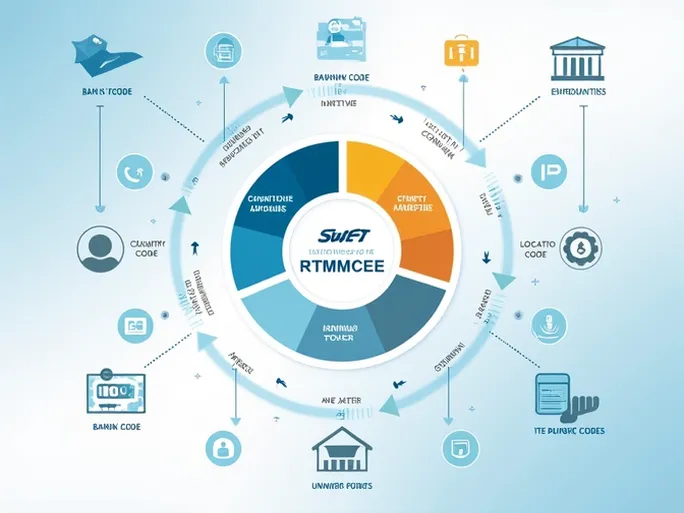

Let’s break down the components of this code. The bank code (UNCR) , consisting of four letters, identifies UNICREDIT S.P.A. itself. Next, the country code (IT) clearly refers to Italy, indicating where the bank is based. The location code (MM) specifies the bank’s headquarters, while the branch code (CEE) identifies a particular branch—with “XXX” typically denoting the bank’s main office.

Using the correct SWIFT/BIC code for international transfers is crucial. It helps prevent errors and delays while safeguarding the entire transaction. Always verify that the bank name you provide matches the recipient’s bank. If you’re using a branch-specific SWIFT code, confirm that the recipient has designated that particular branch for the transfer. Given the global distribution of bank branches, ensuring the SWIFT code corresponds to the recipient’s country is vital for the funds to reach their destination accurately.

In summary, correctly using UNICREDIT S.P.A.’s SWIFT/BIC code (UNCRITMMCEE) is a critical step in international money transfers. Understanding the structure of this code not only enhances efficiency but also protects your financial security. For anyone conducting cross-border transactions, overlooking this detail could disrupt the smooth flow of funds.