International wire transfers often encounter delays or complications when SWIFT/BIC codes are inaccurate. A clear understanding of these codes' structure and significance can prevent such issues. The SWIFT/BIC code, consisting of 8 to 11 characters, serves as a unique identifier for financial institutions worldwide.

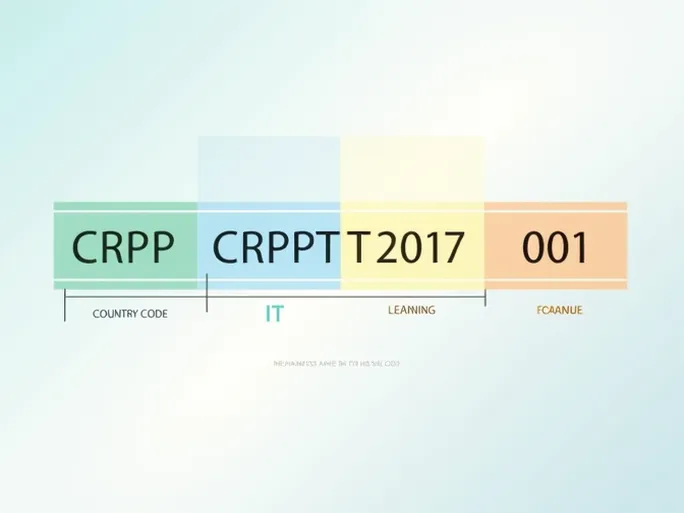

Consider CREDIT AGRICOLE ITALIA S.P.A. as an example, with the SWIFT/BIC code CRPPIT2P001 . This code breaks down into four distinct components:

Decoding the SWIFT/BIC Structure

Bank Code (CRPP): The initial four letters uniquely identify CREDIT AGRICOLE ITALIA S.P.A., ensuring funds reach the correct financial institution.

Country Code (IT): The subsequent two letters indicate Italy as the bank's location, confirming the destination country.

Location Code (2P): This segment specifies the bank's headquarters, facilitating accurate routing during the transfer process.

Branch Code (001): The final three digits designate a particular branch. Using the correct branch code is essential for successful transactions when dealing with institutions that have multiple branches.

When a SWIFT code concludes with "XXX," it typically refers to the institution's primary office, suitable for transfers not requiring specific branch designation.

Essential Verification Steps

Before initiating an international transfer, verify these critical details:

- Bank Name: Confirm the recipient bank's exact legal name matches your records

- Branch Information: When using branch-specific codes, ensure alignment with the actual receiving branch

- Country Verification: Cross-check that the SWIFT code's country designation corresponds with the intended destination

Proper attention to these elements enhances the efficiency and reliability of cross-border payments, minimizing potential delays or additional charges associated with incorrect transfers.