In today's increasingly globalized economy, international money transfers have become an essential part of daily operations for both individuals and businesses. Whether multinational corporations need to pay suppliers or individuals wish to support family members abroad, the demand for cross-border transactions continues to grow. In this process, SWIFT/BIC codes serve as crucial tools that facilitate secure and efficient fund transfers worldwide.

Understanding SWIFT/BIC Codes

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) operates a global financial messaging network, while the Bank Identifier Code (BIC) represents a unique alphanumeric combination that identifies specific banks. When conducting international transfers, using correct SWIFT/BIC codes helps prevent payment errors and ensures funds reach the intended recipient's account accurately.

For example, CREDIT AGRICOLE ITALIA S.P.A. in Italy uses the SWIFT/BIC code CRPPIT2P007. This sequence isn't merely a random combination—it contains detailed bank information that enables tracking and verification throughout the financial transaction process.

Decoding the SWIFT/BIC Structure

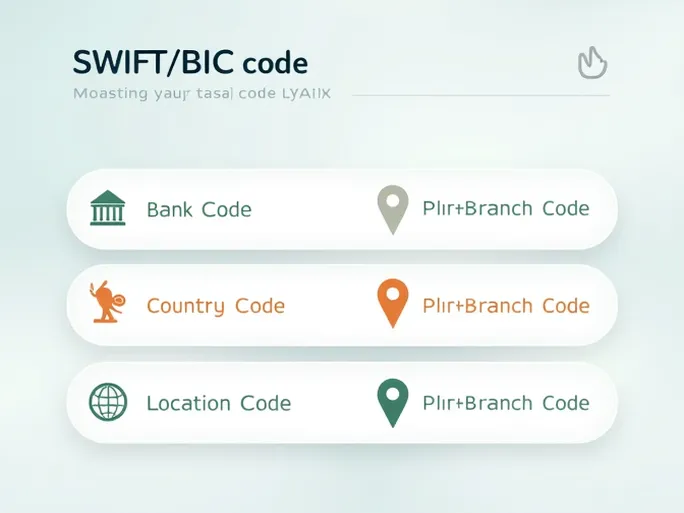

SWIFT codes typically consist of 8 to 11 characters with the following components:

- Bank Code (CRPP): The first four letters identify the financial institution. In our example, CRPP represents CREDIT AGRICOLE ITALIA S.P.A.

- Country Code (IT): The following two letters indicate the bank's location—IT for Italy in this case. Accurate country codes are essential for international transfers.

- Location Code (2P): These two characters specify the bank's primary office location, which can influence processing speed.

- Branch Code (007): The final three digits identify specific branches. When a SWIFT code ends with "XXX," funds route directly to the bank's headquarters rather than a branch.

Key Considerations for International Transfers

To ensure successful transactions, senders should verify several critical details:

- Bank Name Verification: Confirm the exact legal name of the recipient bank, avoiding abbreviations or informal variations.

- Branch Code Accuracy: When transferring to specific branches, precise SWIFT/BIC codes prevent misdirected payments.

- Geographical Alignment: Ensure the SWIFT code's location information matches the destination country to prevent processing delays.

Optimizing International Money Transfers

Modern financial service providers offer advantages over traditional bank transfers, including competitive exchange rates and transparent fee structures. Many platforms provide real-time rate comparisons, allowing users to make informed decisions about currency conversion.

Transparent pricing models eliminate hidden charges by disclosing all fees before transaction completion. This approach enables senders to calculate exact recipient amounts with confidence.

Processing speed represents another critical factor, with many digital services completing most international transfers within one business day. This efficiency proves particularly valuable for time-sensitive transactions.

Professional customer support teams assist users throughout the transfer process, offering guidance on SWIFT code usage and addressing any transaction concerns.

As cross-border payments become more frequent in our interconnected world, SWIFT/BIC codes continue to provide the foundation for secure global financial transactions. Understanding their structure and proper application helps ensure smooth, efficient money transfers across international borders.