When making international wire transfers, ensuring the accuracy of the SWIFT/BIC code is crucial. Imagine funds intended for swift delivery delayed due to an incorrect code—a scenario far from uncommon. This underscores the importance of verifying each bank’s unique SWIFT identifier. This article examines the SWIFT code structure of Banca Nazionale del Lavoro S.p.A. (BNL) and its significance in cross-border transactions.

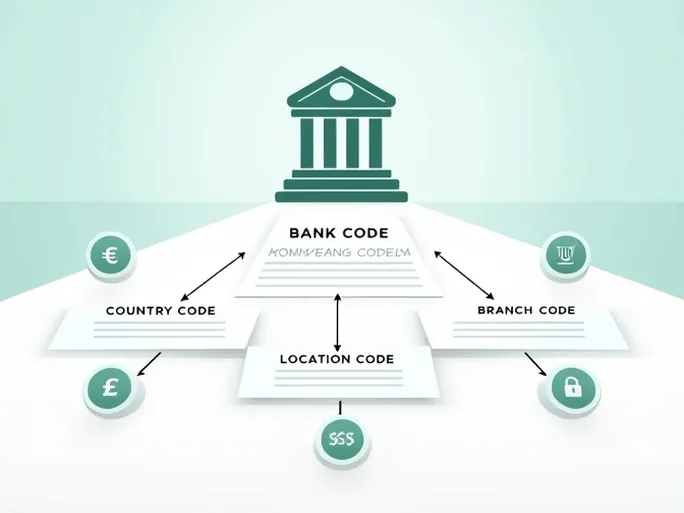

BNL’s SWIFT code, BNLIITRRARX , is a composite of distinct segments conveying specific information. The first four characters, BNLI , represent the bank’s unique identifier. The following two letters, IT , denote Italy as the country of origin. RR indicates the bank’s registered location in a major financial hub, while the trailing ARX pinpoints a particular branch. Headquartered at Via Guido Monaco 74 in Arezzo, Italy (ZIP: 52100), BNL requires precise SWIFT code usage to guarantee seamless fund reception.

The integrity of SWIFT/BIC codes directly impacts transaction security and processing speed. Even minor errors can trigger delays or, in extreme cases, fund misrouting. Cross-border senders must confirm that the code aligns with the recipient bank’s current records—especially critical for first-time or high-value transfers. Additional validations, including branch addresses and account details, further mitigate processing risks.

Financial institutions periodically update SWIFT codes due to mergers, reorganizations, or operational changes. Proactively verifying these updates prevents avoidable transfer complications. Submitting outdated codes may reroute payments through intermediary banks, incurring additional fees and extended processing times.

In international finance, meticulous verification of banking details—particularly SWIFT codes—remains foundational to efficient and secure transactions. Diligent preparation minimizes operational risks while optimizing transfer reliability.