In today's globalized financial landscape, ensuring the accurate transfer of funds to international destinations has become increasingly critical. Cross-border transactions involve not only substantial sums but also currency exchanges and compliance with diverse financial regulations. For those considering transfers to Italy's Banca Nazionale del Lavoro S.P.A., understanding the proper procedures is essential for successful transactions.

Understanding SWIFT/BIC Codes

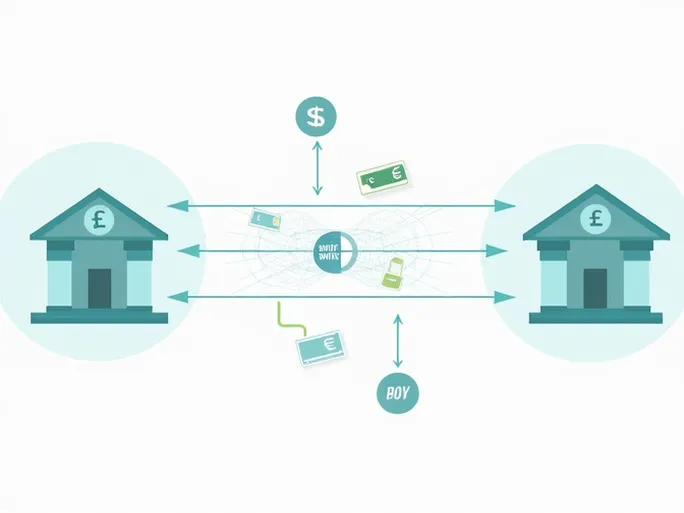

SWIFT/BIC codes, typically consisting of 8 to 11 characters, serve as fundamental components in international financial transactions. These unique identifiers facilitate the precise routing of funds across global banking networks. The acronym SWIFT stands for "Society for Worldwide Interbank Financial Telecommunication," while BIC denotes "Bank Identifier Code." The correct use of these codes prevents transfer delays and misdirected payments.

When initiating international transfers, senders must provide the recipient bank's SWIFT code along with account details and branch information. For Banca Nazionale del Lavoro S.P.A., the code BNLIITRRAVX serves as the standardized identifier enabling global financial networks to process transactions efficiently.

Bank Information

- Bank Name: Banca Nazionale del Lavoro S.P.A.

- City: Avellino

- Address: Via Salvatore De Renzi 34-40, Avellino, AV, 83100

- Country: Italy

As one of Italy's established financial institutions, Banca Nazionale del Lavoro provides comprehensive banking services spanning retail, corporate, and investment banking sectors.

Critical Verification Steps

Before executing transfers using code BNLIITRRAVX, meticulous verification of all details is paramount:

- Confirm the exact match between provided and official bank names

- Verify branch-specific codes when applicable

- Ensure country codes align with the recipient's location

Potential Transfer Complications

Incorrect SWIFT code usage may result in delayed, returned, or lost transfers. Additional considerations include:

- Transaction fees at originating and receiving institutions

- Exchange rate impacts on final amounts received

- Processing timelines typically ranging from 2-5 business days

Security Considerations

Heightened vigilance against financial fraud is essential during international transactions. Always verify banking details through official channels and avoid sharing sensitive information through unsecured communication platforms.

Code Verification Methods

Authoritative sources for SWIFT/BIC confirmation include:

- Official bank websites

- Dedicated international banking code directories

- Direct inquiries with bank representatives

In an era of evolving financial regulations and economic uncertainty, meticulous attention to transfer details remains the most effective safeguard for international transactions. Proper verification of banking information and adherence to established protocols ensures secure and efficient cross-border fund transfers.