In today's globalized era, the complexity of financial transactions continues to grow. Bank transfers serve not only as a fundamental method of money movement between individuals and businesses but also play a crucial role in the international economic system. Understanding the mechanics of international transfers—particularly the importance of SWIFT codes—has become essential knowledge for anyone engaging in cross-border financial activities.

Decoding SWIFT: The Backbone of International Transfers

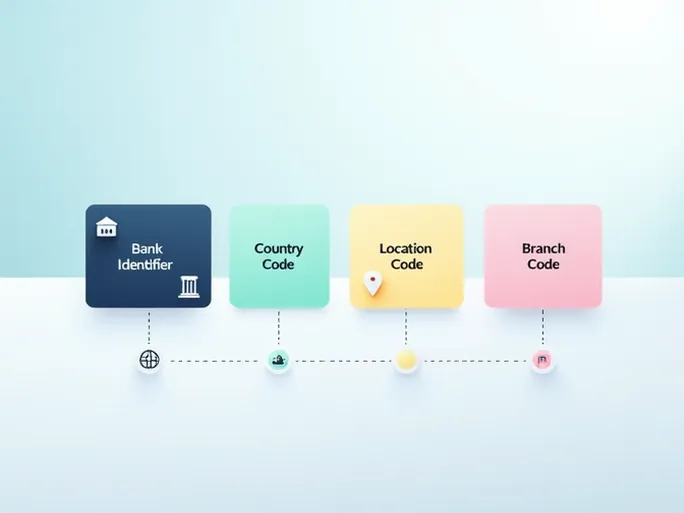

A SWIFT code (Society for Worldwide Interbank Financial Telecommunication) serves as the unique identifier for financial institutions participating in global money transfers. This standardized system enables banks worldwide to securely and efficiently exchange financial messages and transfer funds. Each SWIFT code consists of 8-11 alphanumeric characters that precisely identify the recipient bank, its country, and sometimes even specific branches.

For those transferring funds to Italy, Banca Nazionale del Lavoro S.p.A. stands as one of the country's most established financial institutions. Founded in 1934, this bank has grown to become a pillar of Italy's financial infrastructure, offering comprehensive banking solutions while maintaining a strong commitment to supporting the national economy.

Breaking Down the SWIFT Code: BNLIITRRALX

The SWIFT code BNLIITRRALX contains several layers of information critical for successful fund transfers:

•

BNLI

- The bank's unique identifier (Banca Nazionale del Lavoro)

•

IT

- Country code for Italy

•

RRAL

- Location/branch identifier

•

X

- Optional branch code

This precise coding system ensures that funds reach their intended destination without errors. In international transfers—especially those involving significant amounts like €4,500 (approximately $8,485)—entering the correct SWIFT code becomes absolutely critical. An incorrect code could result in funds being misdirected or delayed, potentially causing financial complications and damaging business relationships.

Navigating Modern International Transfers

While digital banking platforms have simplified the transfer process, users must remain vigilant about several key factors:

•

Verification

: Always confirm SWIFT codes through official bank documentation or verified digital sources rather than relying on memory or word-of-mouth

•

Exchange Rates

: Monitor currency fluctuations as market conditions can significantly impact the final amount received

•

Transfer Tracking

: Utilize bank notification systems (email/SMS alerts) to monitor transfer status in real-time

For businesses engaged in international trade, understanding SWIFT protocols becomes even more crucial. As companies increasingly operate across borders, the ability to execute secure, efficient transfers forms the foundation of successful global commerce. Whether processing payments, receiving funds, or managing overseas accounts, accurate financial information ensures smooth operations.

Mastering these financial fundamentals—from understanding SWIFT codes to navigating currency exchanges—empowers both individuals and businesses to operate confidently within the global financial system. In an interconnected economic landscape, this knowledge transforms from mere convenience to essential financial literacy.